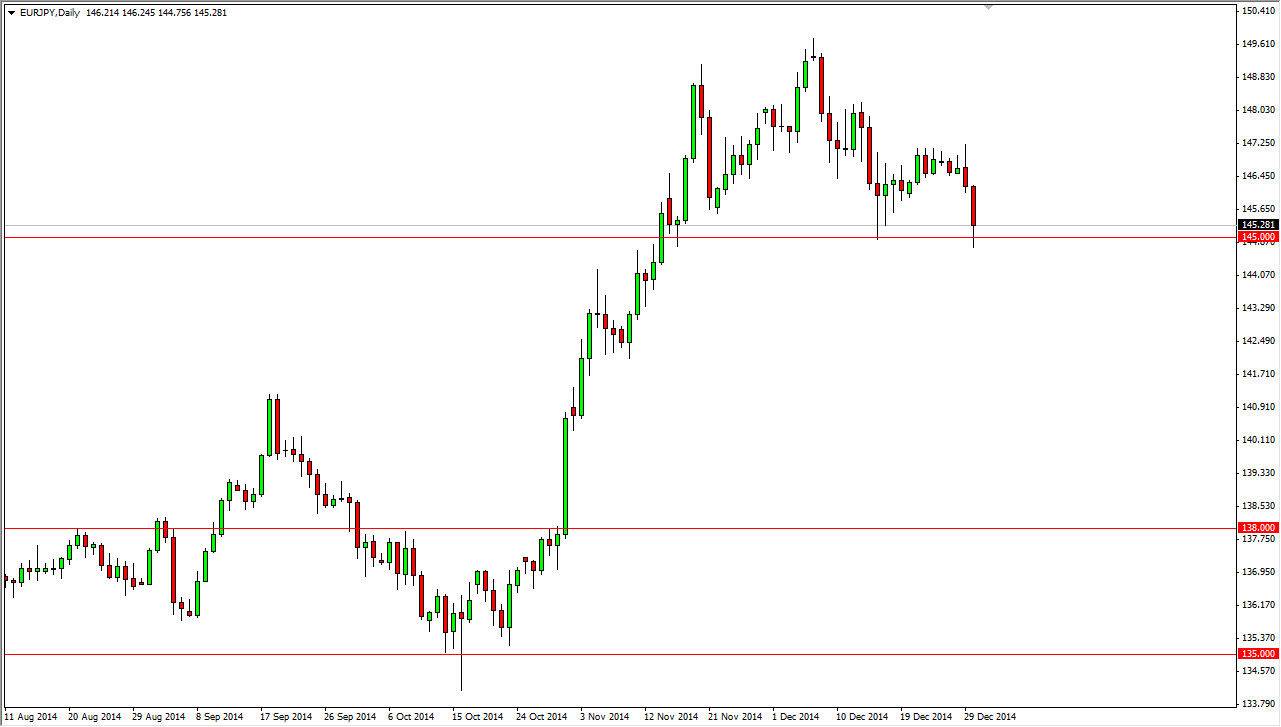

The EUR/JPY pair fell during the course of the day on Tuesday, slamming into the 145 level. That is an area that I see is massively supportive, but I will admit that there are is the possibility that we go lower from there as well. After all, I see quite a bit of support below at the 144 level, and possibly even as low as 142.

The pair tends to be very risk sensitive, and as a result you will have to watch the stock markets around the world as well. There is the possibility that we are starting to see a little bit of profit taking, so we could continue to fall from here. Nonetheless, I will be watching this pair with great interest as I think sooner or later the uptrend continues. The Japanese yen of course is softening overall, so I have no interest whatsoever in shorting this market. I don’t necessarily like the Euro at the moment, but it’s only a matter of time between now and further weakness from time to time, but ultimately am starting to look at the Euro as possibly starting to find its legs a little bit.

Being patient is what is needed

This market is one that I believe it will go higher given enough time, but you are going to need to show patience in order to make money. After all, we are in a time of the year that markets can have minds of their own, as not only do we have liquidity issues, but we also have the issue of people taking profits in order to show gains to their clients.

Ultimately, I think that the 140 level is essentially the floor in the market, and as a result any type of supportive candle we see between here and there as far as I can tell is a buying opportunity. Ultimately, this market should then go to the 150 level, and possibly even break out above there are the course of the next couple of weeks or months. I’m a buyer on dips but we need to see supportive candles.