The EUR/USD pair rose during the session on Wednesday, smashing into the 1.25 level. This is where I suspect we will see quite a bit of resistance though, so quite frankly feel it’s only a matter of time before the sellers come back into this marketplace and push the Euro down. After all, the market is in a downtrend, and as a result we feel that the bearish pressure will continue. The US dollar continues to be the strongest currency out there, so really at this point time I have no interest in going against it anyway. With that being the case, I feel that it’s probably a pair that will continue to go much lower, and that should be the theme going forward for the next couple of months.

I think that rallies are simple opportunities to take advantage of value in the US dollar, as it should continue to strengthen over the longer term. I also think that there is a significant amount resistance above the 1.25 handle as well, as the 1.26 level should be rather resistive as well.

Trend continues…

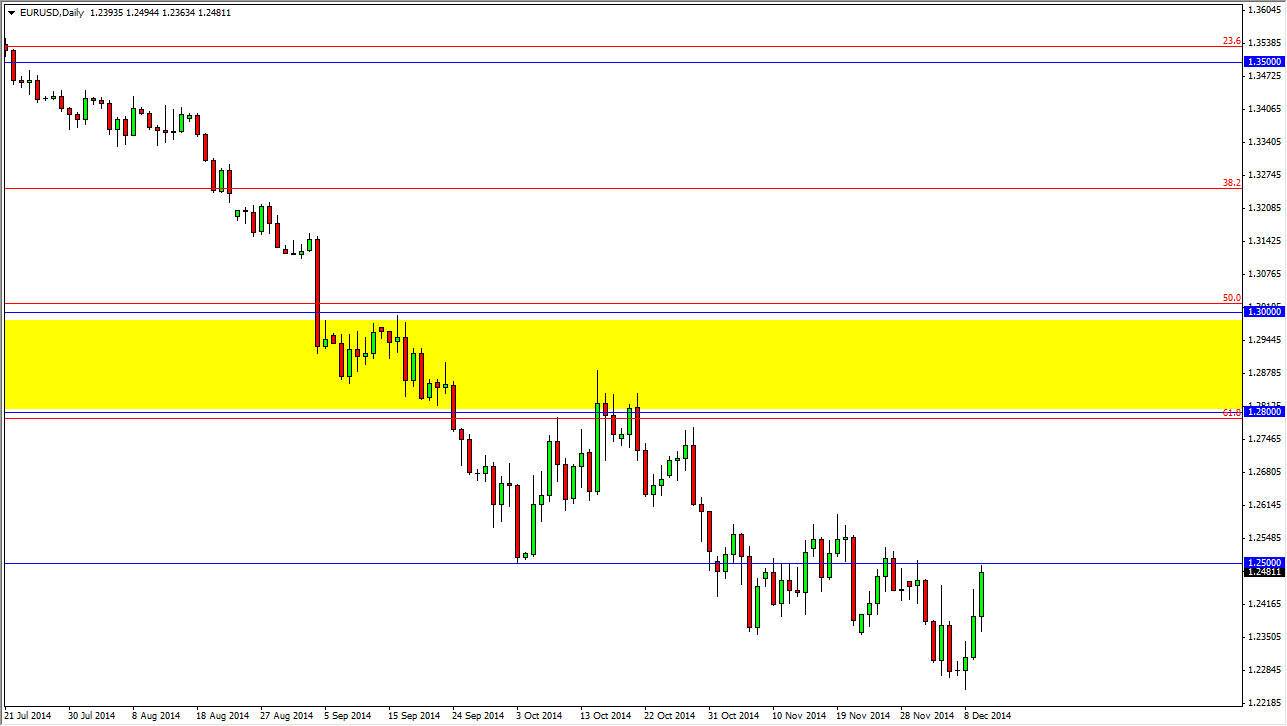

The overall trend should continue going forward, and as a result I have no scenario in which a willing to start buying this pair until we get at least above the 1.30 level, as that would in my opinion change the trend overall. Between here and there, there should be plenty of opportunities to sell the Euro, and as you can see on the chart I have a large yellow box of that needs to be overcome before I can even think about selling the US dollar.

Ultimately, I believe with the US Dollar Index looking to reach the 90 handle, it’s almost impossible to go against it. After all, the EUR/USD pair is the largest component of the US Dollar, and that of course looks very bullish. Ultimately, I believe that this will continue to fall based on the fact that the US dollar in general should continue to strengthen. The European Central Bank will almost certainly have to loosen its monetary policy, but there is a threat of a short-term rallies in this pair simply based upon profit taking.