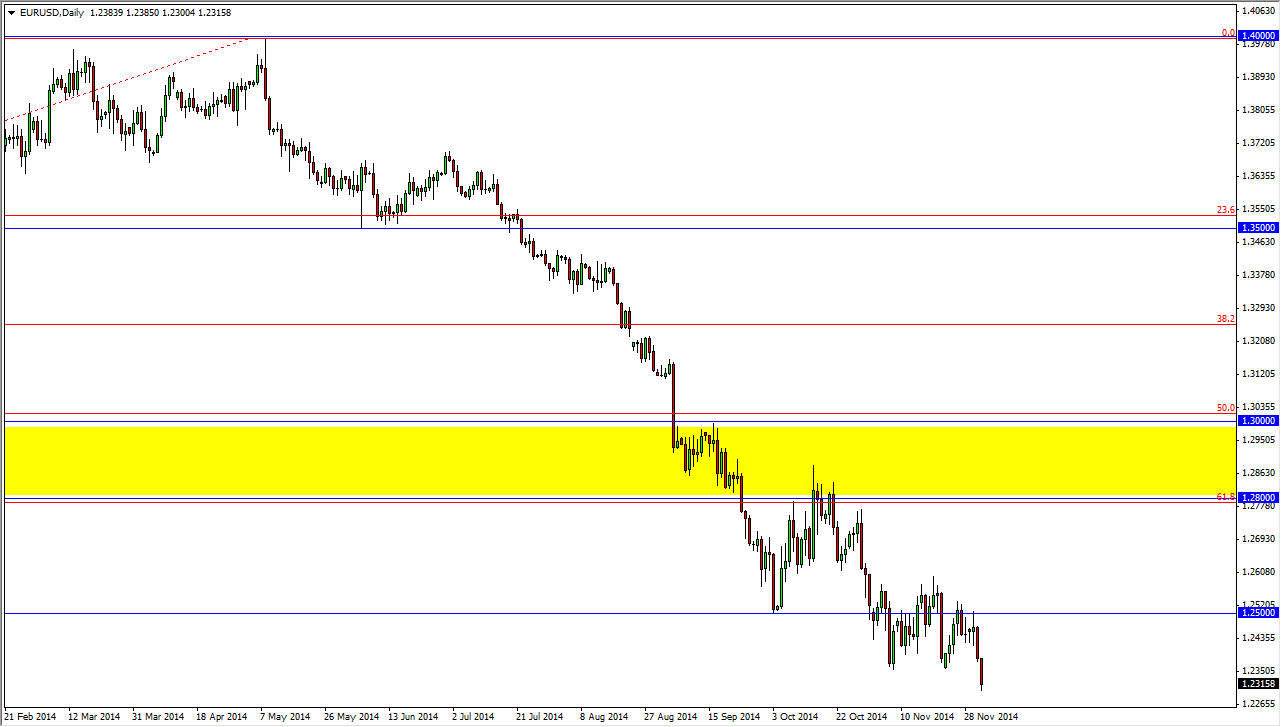

The EUR/USD pair broke down during the session on Wednesday, breaking below the 1.24 region. Because of that, it appears that the market is ready to continue going lower, and as a result I believe that the Euro is going to continue falling not only today, but probably Friday as well. Remember though, we do have an interest rate decision coming out of the European Central Bank, so there could be a bit of volatility in this market today. Nonetheless, any rally at this point in time offers a selling opportunity as far as I can see, as the trend is most certainly set.

I think that the 1.26 level above will be massively resistive, and it’s only a matter time before the sellers step back in and push this pair down. After all, the US dollar continues to be the strongest currency out there, and with good reason. After all, the Federal Reserve has step away from quantitative easing and it appears that the US dollar will continue to attract money.

Round trip

I still believe that this pair is going to do a “round-trip”, sending this market back down to the 1.2050 level. That is where we started the entire uptrend that is now being destroyed. With that being the case, I feel that it’s only a matter of time before we retest the area, but we could have quite a bit of choppiness between here and there. Ultimately, the market is in a bearish trend, and I just don’t see that changing considering that the European Central Bank is probably going to have to expand its monetary policy sooner or later.

Because of this, I will continue to look at rallies as selling opportunities as I just don’t trust the Euro right now. Ultimately, the market will grind its way lower and I believe that selling the Euro is the only thing you can do with it, especially as the US dollar. However, I recognize that there will be ebbs and flows, and that of course means volatility.