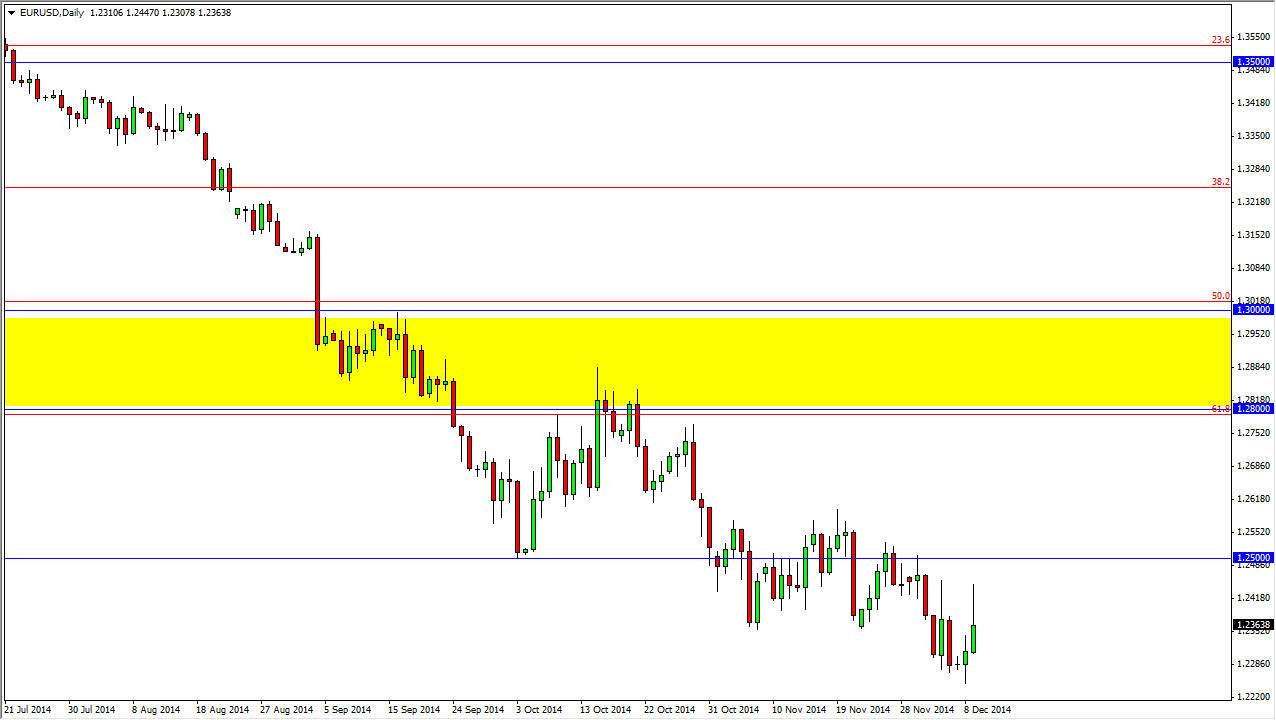

The EUR/USD pair initially rallied fairly significantly during the session on Tuesday, but the closer we get to the 1.25 level we begin to see quite a bit of selling pressure. Of course Tuesday was no different, and the market continues to struggle in that general vicinity. With that being the case, the market looks as if it is one that you can sell every time it rallies, and I have done fairly well doing exactly that. When you look at this chart, not only is the 1.25 level pretty resistive, I believe that the 1.28 level and the 1.3 level above that need to be overcome in order to comfortable buying again.

The US dollar continues to be the favored currency by Forex traders around the world, so therefore there is no way for me to feel comfortable shorting it against pretty much any currency anyway. That will be especially true against the Euro, which is absolutely anemic at the moment as far as its demand is concerned.

Continue to sell the rallies

I believe that this is a market that we can simply sell every time it rallies, probably based upon shorter-term moves. It’s only a matter time we fall away down to the beginning of the uptrend, the 1.2050 handle. It is down there that I think that we may finally see the market turnaround for the longer term, but right now there are no real signs of bullish momentum entering the market for any real length of time.

I believe that the thin liquidity in the currency markets during the latter half of the month of December could have this market flying around and making a lot of erratic moves, but ultimately every time we rally there should be an opportunity to take advantage of that. I don’t really have a scenario in which a willing to buy this pair, as I believe that the European Central Bank will have to continue to ease its monetary policy while the Federal Reserve clearly is walking away from its loose monetary policy at this point in time.