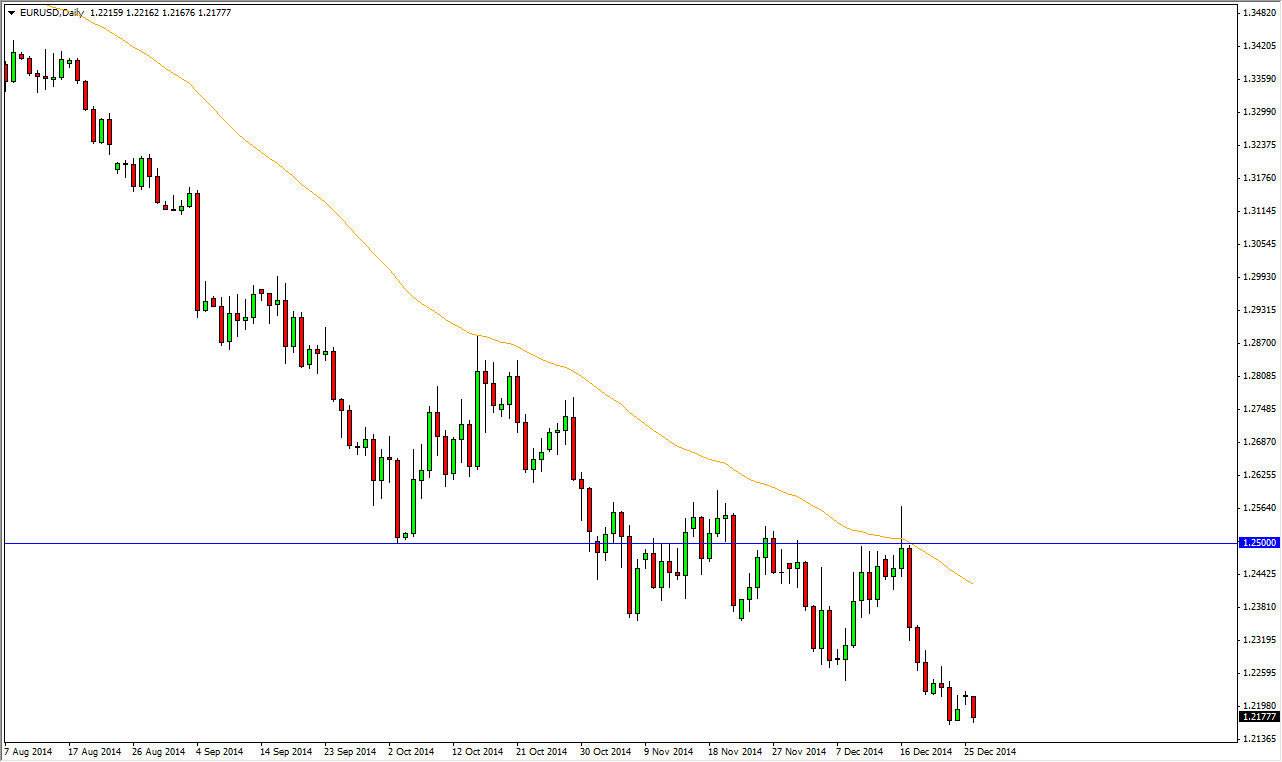

The EUR/USD pair fell during the session on Friday as per usual, but as you can see did and make a fresh, new low. That being the case, the market looks as if it’s ready to continue to go lower but doesn’t quite have enough momentum yet. That doesn’t mean that it won’t though, because after all we have seen a nice trend for some time now. On the chart, you can see I have attached the fifth the exponential moving average for the daily time frame, and as a result you can see just how reliable this trend has been.

However, it does look like we need to “revert to the mean” in a sense, so it is possible that we could get a little bit of a bounce from here. I look at that bounce as a gift though, as it should allow us to sell this pair at a higher level. That essentially means buying the US dollar “on sale.”

Follow the trend, it still has a way to go.

At this point time, the only thing you can do is follow the trend. Quite frankly, I don’t see any chance of buying the Euro until we get above the 1.26 level, which is something that I don’t see happening anytime soon. Any time between here and there that we see bits of resistance, I am more than willing to start selling again.

Ultimately, I believe that this pair goes to the 1.2050 level. That was the beginning of the uptrend that we have all but destroyed now, and I think we will do the “100% retrace” on the Fibonacci retracement tool. In other words, we are doing what is known as a “round-trip.” Can we get below there? I have no idea but I do recognize that there is a massive amount of support at the 1.20 level on the monthly charts, so quite frankly I think we will see a significant bounce eventually. However, we are not down in that area yet so I think we still have opportunities to sell the Euro in this region.