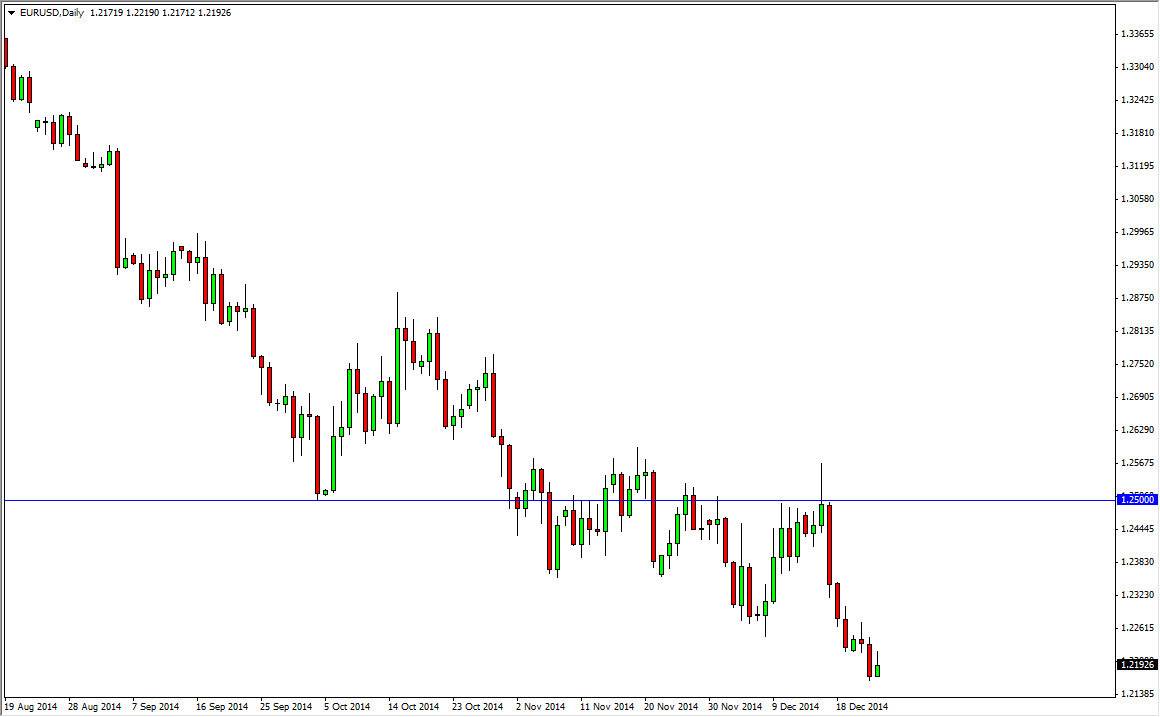

The EUR/USD pair rose during the course of the day on Wednesday, but as you can see struggled above the 1.22 handle, and ended up falling to form a shooting star. The shooting star of course suggests that the sellers are going to come back in and push this market lower. The Euro has been struggling for some time now, and as a result this is not a big surprise. I believe that the Euro will continue to fall over the longer term as well, and as a result I am a seller of all rallies as they come.

I believe that the 1.2050 level continues to be the target longer-term, but I recognize that it’s going to be difficult for the market to reach that level over the course of the next several sessions. After all, most traders will be at holiday, and not concerned about the currency markets. Because of that, I believe that choppiness will continue.

No reason for the Euro to pick up

I don’t really see a reason for the Euro to pick up as far as value is concerned for the longer term. So at this point in time, I believe that any buying opportunity in this pair should probably be ignored. That will be especially true as the liquidity in this marketplace will be all but nonexistent. Because of that, I believe that the moves will be fairly erratic but the only thing that you can trust is going to be the longer-term trend as there is obviously quite a bit of volume behind the move lower.

I also believe that the 1.25 level will be a bit of a “ceiling” in this market, and that the ceiling there extends all the way to the 1.26 handle. Because of that, I think that short-term charts are where you need to be looking for potential opportunities, as that seems to be about as good as the market will get for the next couple of weeks. With that being said, I just don’t see the reason to go long.