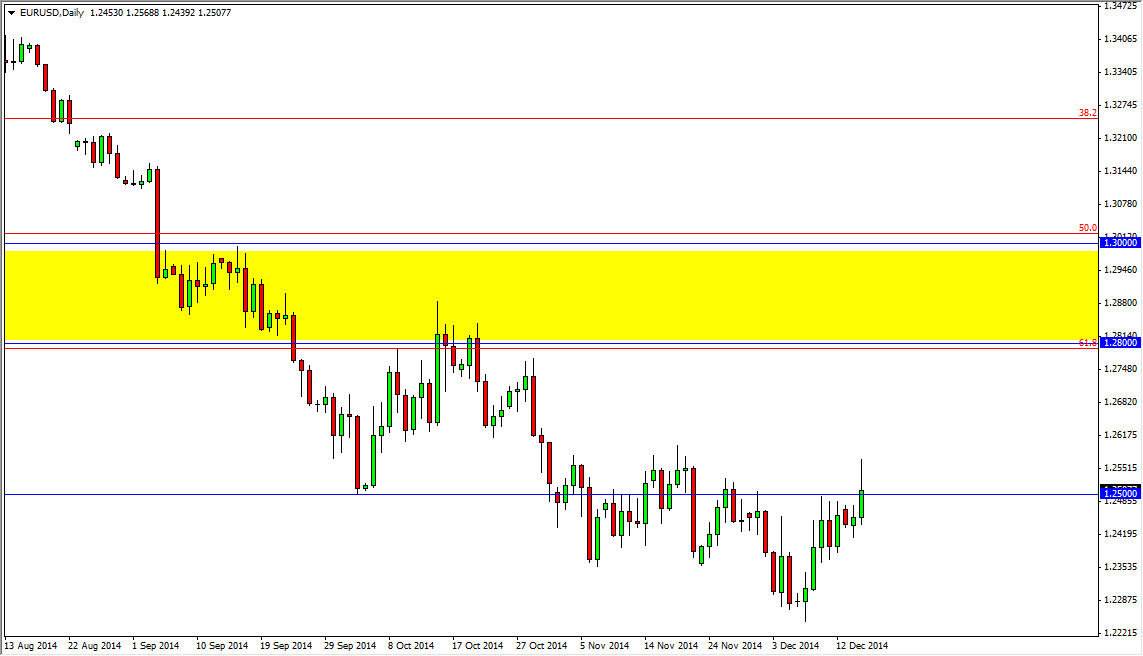

The EUR/USD pair broke higher during the course of the session on Tuesday, but as you can see struggled as we climbed above the 1.25 handle. With that, I believe that this market will continue to find sellers above, and it will be difficult for the bullish of the Euro to hang onto the gains for any real amount of time. With that being said, I am simply waiting for selling opportunities as we drag along towards the end of the year. I think that it’s only a matter of time before we break down, and head towards the 1.2250 level again.

Looking at this chart, the candle for the Tuesday session of course is a bit of a shooting star, which means that we will more than likely have sellers step back into this marketplace and push it down to the 1.2250 region. I think a break of the bottom of the shooting star is the signal that I will use in order to continue to sell the Euro, which is of course is been beaten up against most currencies, and with the US dollar being by far the strongest currency in the Forex world right now, it makes sense we continue seen that.

Continue downtrend over the longer term

Looking at the shape of this candle, it’s very likely that this market continues to go lower overall, and I do think that the resistance runs all the way to the 1.26 level also. I think that it’s only a matter of time for the sellers step back in and take advantage of perceived value in the US dollar, as it is so favored. Besides, as you can see on the chart I have a yellow box that extends from the 1.28 handle all the way to the 1.30 level. In that area I anticipate there is a massive amount of resistance that will keep the market lower.

I have no interest in buying the Euro until we get above the 1.30 handle, which is something that I do not anticipate seen during the month of December. With that, I am very bearish and will more than likely continue to be.