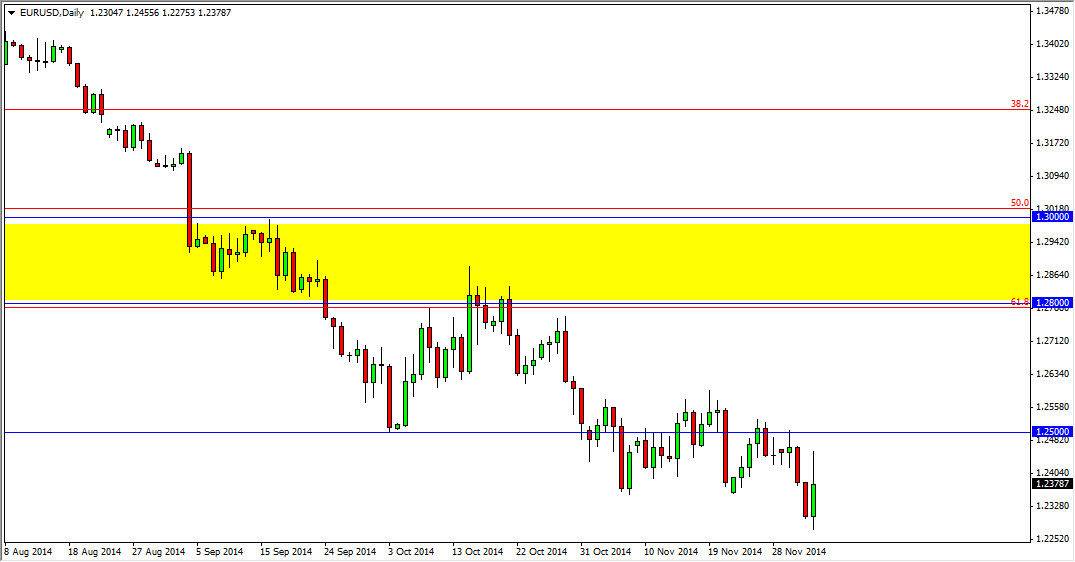

The EUR/USD pair fell after initially rallying during the session on Thursday. It appears of the 1.25 level is going to continue to be rather resistive, and as a result we should see the sellers step back into the marketplace. However, we have nonfarm payroll numbers coming out today and that of course will work against many straightforward and normal logic. Because of that, I feel that the best thing I can do is wait until that announcement comes out and react to it. I believe that there is no way to buy this pair, don’t get me wrong, but rather there is the possibility that I can pick up the US dollar on the cheap so to speak.

Rallies continue to offer selling opportunities

As far as I can see, rallies will continue to offer selling opportunities going forward. What frankly, I just don’t see how you can only Euro with any type of confidence at all. The US dollar continues to be favored, and the US Dollar Index shows that we should continue to go higher given enough time. This pair moves directly inverse to that, so it is a bit of a secondary indicator.

On top of that, if the jobs number comes out fairly strong during the day today, we could see a rush back into the US dollar. We have broken down through pretty significant support, so it makes sense that we continue to drop and look for the beginning of the uptrend that originally started all this, which is out the 1.2050 handle. With that, I believe that rallies offer plenty of value in the US dollar as it is without a doubt the favored asset of traders around the world. I think it is not until we break above the yellow rectangle on the chart, meaning the 1.30 level that we can even consider buying this pair with any type of confidence at all. I believe that short-term traders will continue to jump on the bandwagon and push this pair lower anyway.