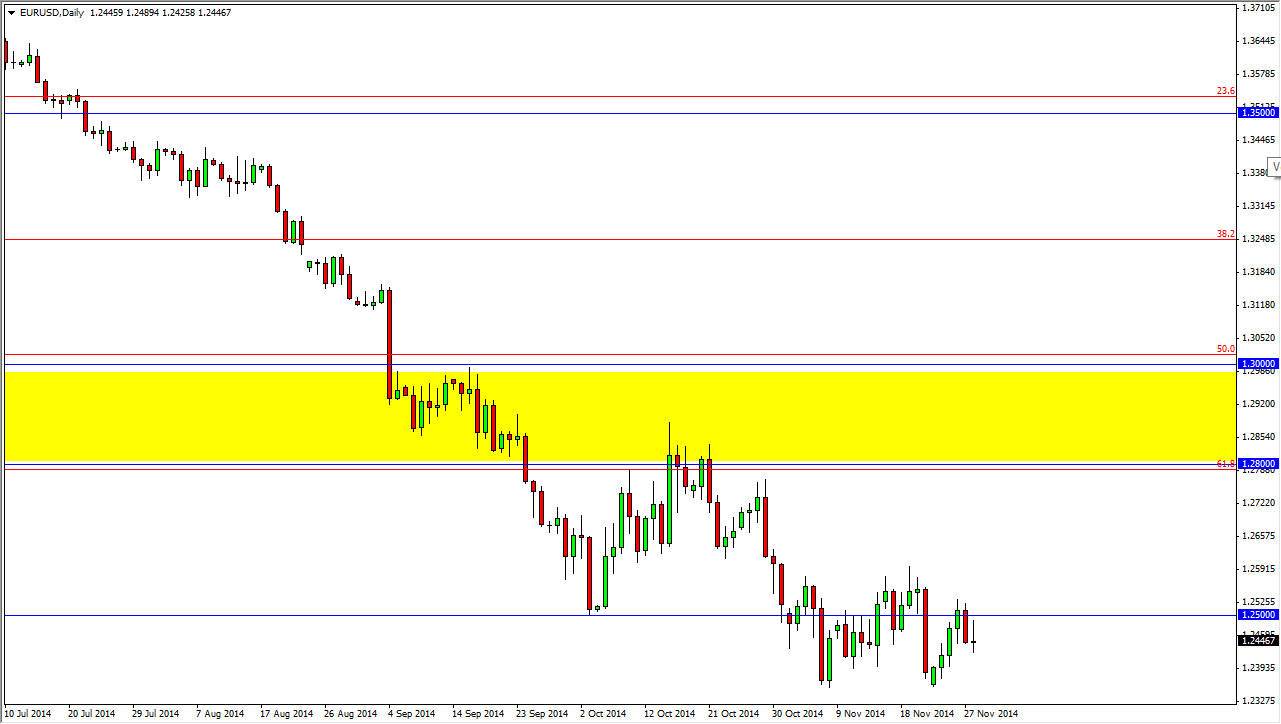

The EUR/USD pair went back and forth during the session on Friday, but as you can see really didn’t end up settling much by the time the market closed. To be honest, the only thing that I can see in this chart is the fact that the 1.25 level offered resistance and we turned back around to form a bit of a shooting star. That being the case, the market looks as if it’s ready to continue to go lower, but it could be a bit choppy in the short-term. Nonetheless, the only thing that I can do is sell this market going forward, and I believe that the area between the 1.25 level and the 1.26 level has been extraordinarily resistive.

If we can break down from here, the 1.2350 level will more than likely be the target. If we can get down there, we will then test the support to see whether or not we can go much lower. I do think that happens given enough time, but it’s probably going to take a bit of momentum building in order to do so. In other words, I believe that the market will continue to bounce around trying to build up enough selling pressure to truly breakthrough.

Follow the trend, and reap the rewards

Follow the trend like this, that’s all you can do. After all, if you would have trying to trade against it you would more than likely have lost money in the process. The European Central Bank should start to loosen its monetary policy even more, while the Federal Reserve of course can be bothered to do so anymore. In other words, this marketplace has a bit of a “perfect storm” going for it, as the Euro should continue to sell off overall. The US dollar continues to be the favored currency around the world, so it’s almost impossible to sell it anyways. With that being the case, we are going lower, and as a result there’s nothing else we can do but sell a market that obviously needs to be sold.