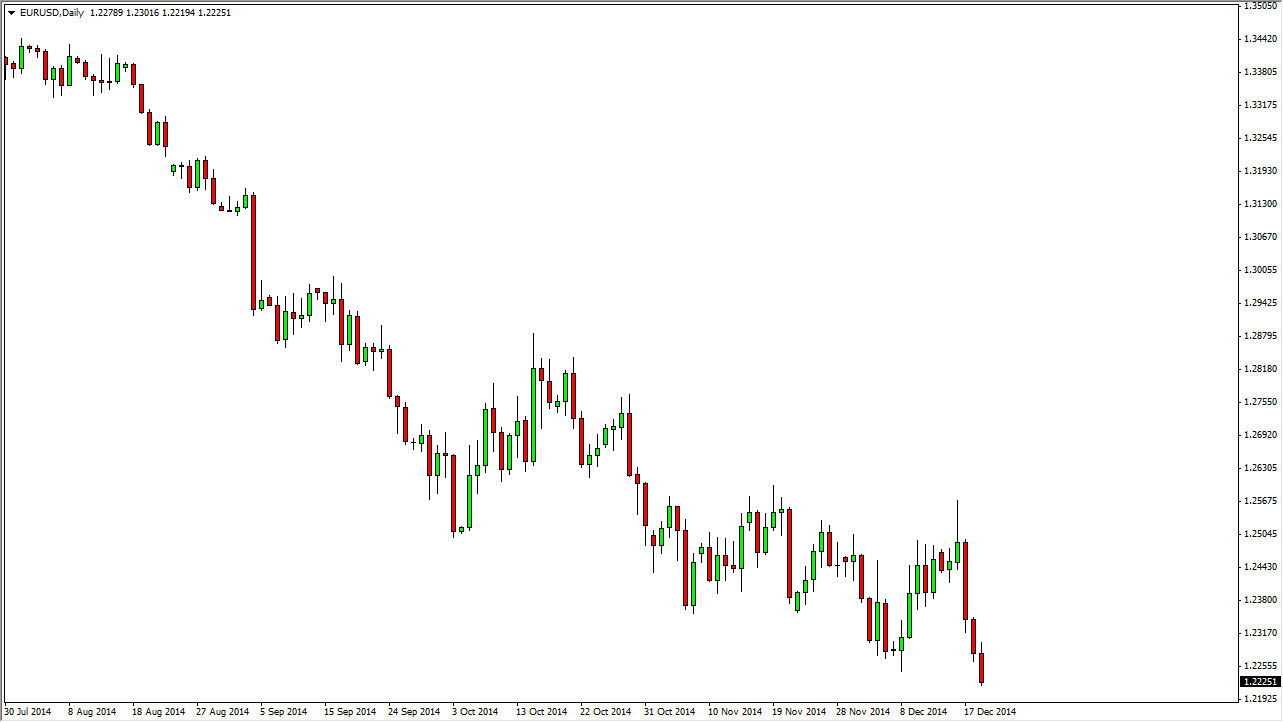

The EUR/USD pair fell again during the session on Friday, as we made a fresh new low. This of course signifies that the sellers are coming back into the marketplace, and should continue to push the value of the Euro lower. On top of that, it’s only a matter of time before the US dollar strength continues to weigh upon this market also, ultimately pushing it down to the 1.2050 level which of course is my longer-term target.

This market could bounce from this low area, but quite frankly I think that would be a nice selling opportunity. It’s probably only a matter of time before we break down again although with Christmas being so close, it is very likely that we could get a little bit of a bounce or some type of “relief rally” in this market that of course has been sold off so aggressively over the last several months.

The trend should continue for the longer term

It appears of the trend should continue over the longer term, so I have no interest in buying. With that being said, I do recognize that the buyers could step in based upon profit-taking, but really I look at that as “value” in the US dollar. This is by far the largest barometer of the US dollar outside of the US Dollar Index futures market, and as a result I look at both ends see absolutely no reason to think that this pair will go higher anytime soon.

Ultimately, I believe that the 1.25 level is massively resistive, and have a hard time believing that this market will break above there. With that being the case, I feel that the market will more than likely be one that’s relatively reliable, but at this late date in the year, lack of liquidity will come into play, meaning that the market could have sudden and erratic moves. Nonetheless, I am a seller of a long-term, and therefore am ignoring buying opportunities.