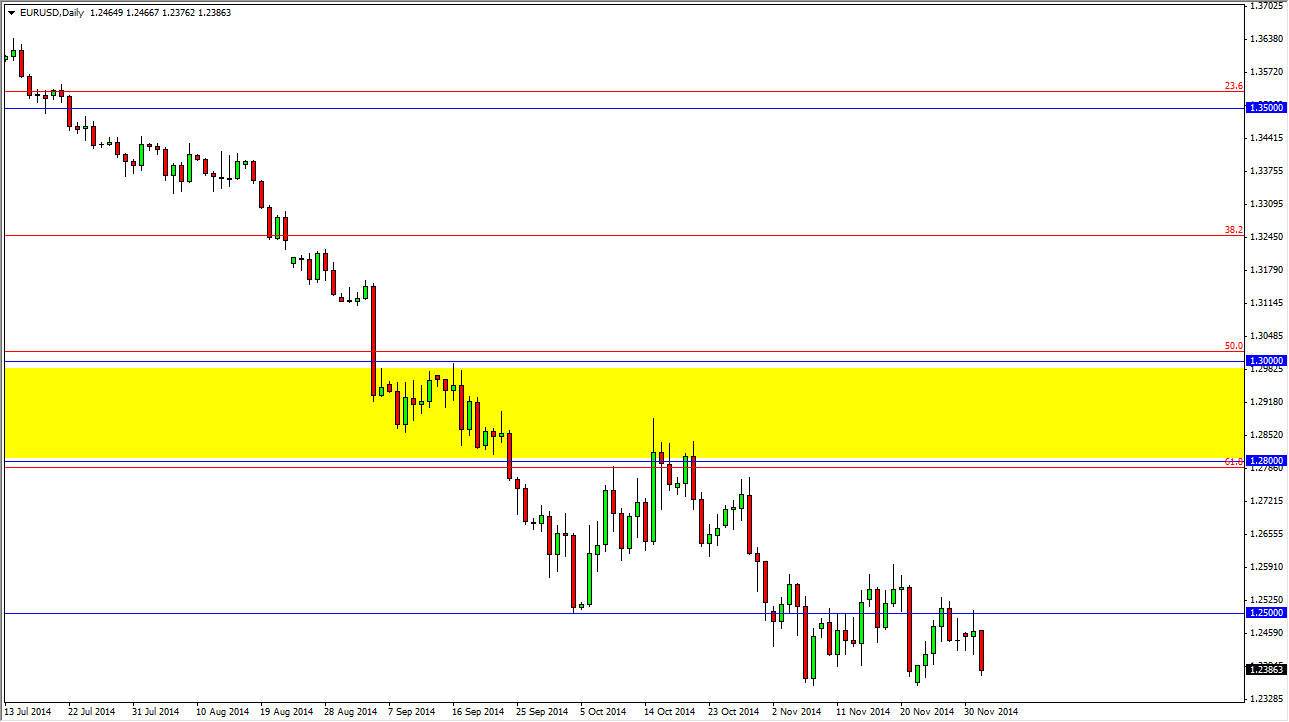

The EUR/USD pair fell yet again during the session on Tuesday, as we continue to see bearishness in the market overall. We believe that the 1.2350 level should offer significant support, but it is only a matter of time before we continue to go much lower. With that being the case, we feel that the market will ultimately be one that you can sell every time it rallies, as rallies certainly cannot be trusted. By believe that the 1.26 level will continue to be a bit of a ceiling in the marketplace, and as a result I think that short-term traders will come aboard as well in order to sell.

Looking at this chart, you can almost make an argument for some type of ascending triangle, although it is a necessarily perfect. That being the case, I feel that the market will ultimately break down and head towards the 1.2050 level, which was the beginning of the overall uptrend. With that, we believe that the market will eventually be a strong sell, but right now it is fairly quiet.

Continued downtrend

I believe that this market will continue to the downside, as the sellers will continue to jump on the fact that the market is so negative, and as a result will continue to offer plenty of selling opportunities. At this point time I think that any time we rally it’s going to be an opportunity to take advantage of perceived value in the US dollar overall.

With that being said, it’s probably only a matter of time before the bottom falls out, so I am very hesitant to buy this market. In fact, there is a yellow rectangle above that we would have to break out above and above in order to consider buying this market. With that, this is a “sell only” marketplace, and we believe that it will be that way for the next several months, and 2015 will more than likely start out very negative as far as the Euro is concerned. Ultimately, the interest-rate outlook should continue to favor the US dollar over the longer term.