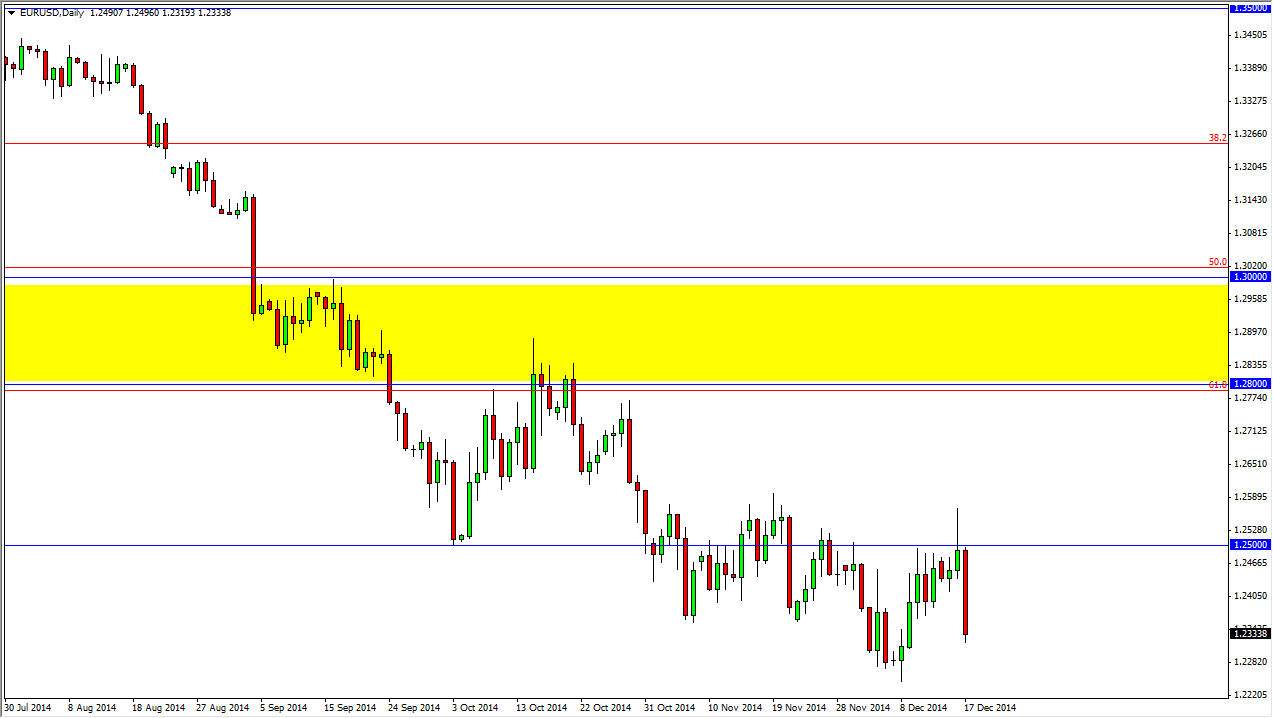

The EUR/USD pair fell hard during the course of the session on Wednesday, breaking the bottom of the shooting star that form perfectly at the 1.25 level on Tuesday. That being the case, the market looks as if it’s ready to head down to the 1.2250 level where we had seen quite a bit of buying pressure previously. With that, I feel that this market will continue to be very negative, and it’s only a matter of time before we break down below even that level. After all, the Euro has been selling off drastically for some time now, and there’s absolutely nothing to make me think that it’s going to change direction over the longer term anytime soon.

The European Central Bank continues to flaunt very weak monetary policy, and should only end up expanding on that. With that being the case, I don’t see any reason for the Euro to gain beyond profit taking in the near term. Because of this, I think it every time this market rallies, you have to start thinking about value in the US dollar, and selling this pair at the first signs of weakness.

Much lower levels ahead

I believe that there are much lower levels ahead, and I do think that eventually this market goes all the way down to the 1.2050 level. That was the beginning of the uptrend that we have now certainly reversed, and with that I feel that this market will continue to be one that you can trade to the downside for some time. Ultimately, I feel that this market is one that will be a bit of a bandwagon for people this coming spring, as we continue to punish the Euro. The human wrong, I think eventually we turn around but that is a long way away from here.

With that being said, I continue to sell through the rest of the year, and I don’t see any opportunity to buy this market until we get above the yellow box at the 1.30 level. Above there on a daily close, and then I think the trend goes to the upside again but that really isn’t going to be anytime soon as far as I can see.