EUR/USD Signal Update

Yesterday’s signals expired without being triggered, as although the price did hit 1.2400, there was no bearish price action on the H1 chart at this level.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm London time.

Short Trade 1

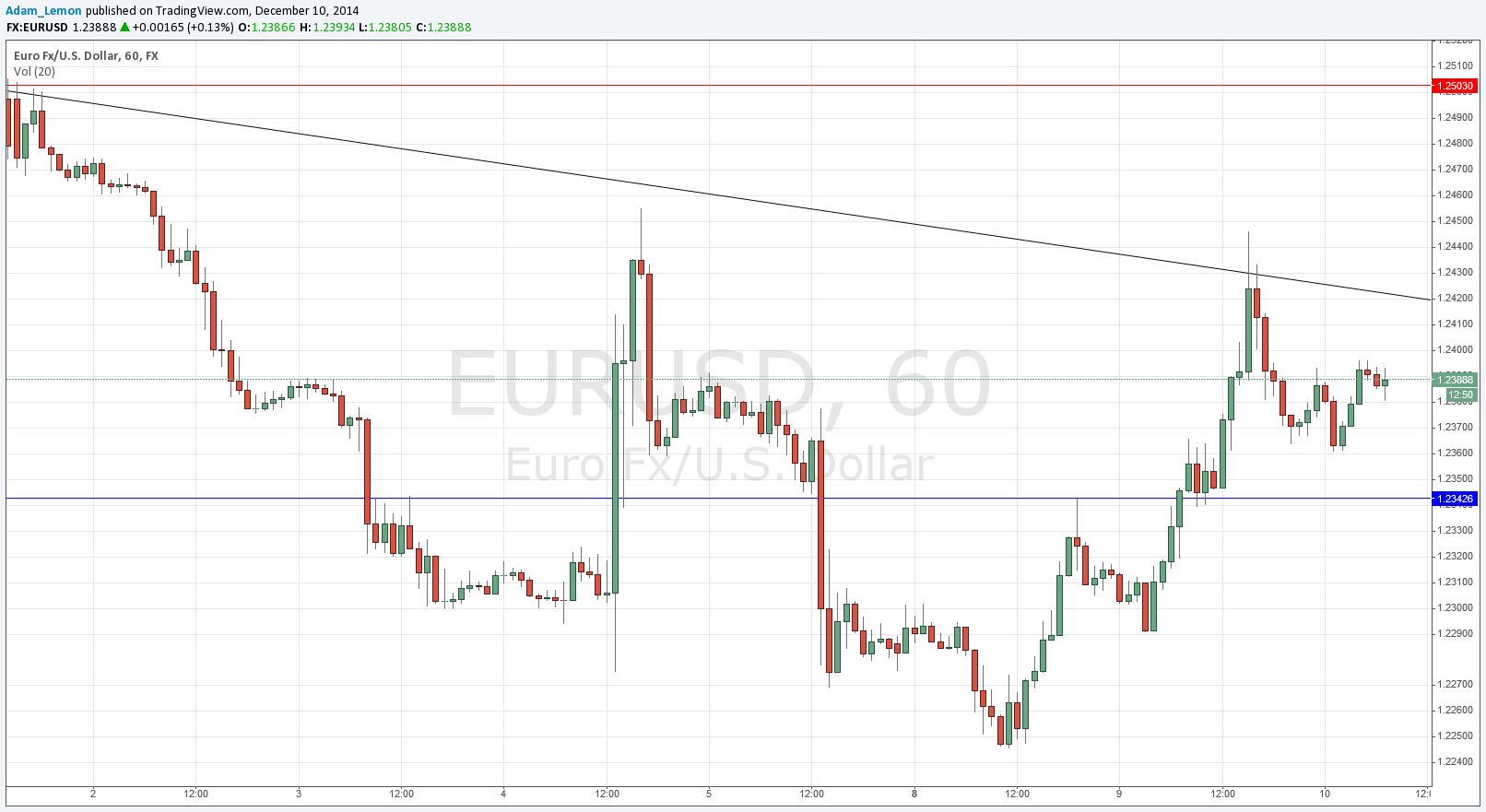

Short entry after bearish price action on the H1 time frame immediately following the next touch of the bearish trend line shown in the chart below.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2503.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 1.2343.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run

EUR/USD Analysis

I wrote yesterday that the bearish trend line (shown unchanged in the chart below) had to be broken to the upside to confirm real bullishness. We did have a bullish day in this pair yesterday, which flipped resistance to support at 1.2343 and then again at around 1.2366, although the 1.2343 level looks more reliable. However after moving up very quickly, the price stalled at the bearish trend line as expected, in an area that was above 1.2400 but fairly confluent with a similar recent swing high.

The price should now either manage to really break above the trend line and proceed to 1.2500, or turn around at the next test of the trend line and fall. Alternatively, we may fall back to 1.2343 first, and pick up steam there for another charge at the trend line, which might make a successful break out more likely.

There are no high-impact data releases scheduled today directly concerning either the EUR or the USD.