EUR/USD Signal Update

Last Thursday’s signals expired as although the price did reach 1.2401, there was no bullish price action at this level following the first touch.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be made between 8am and 5pm London time.

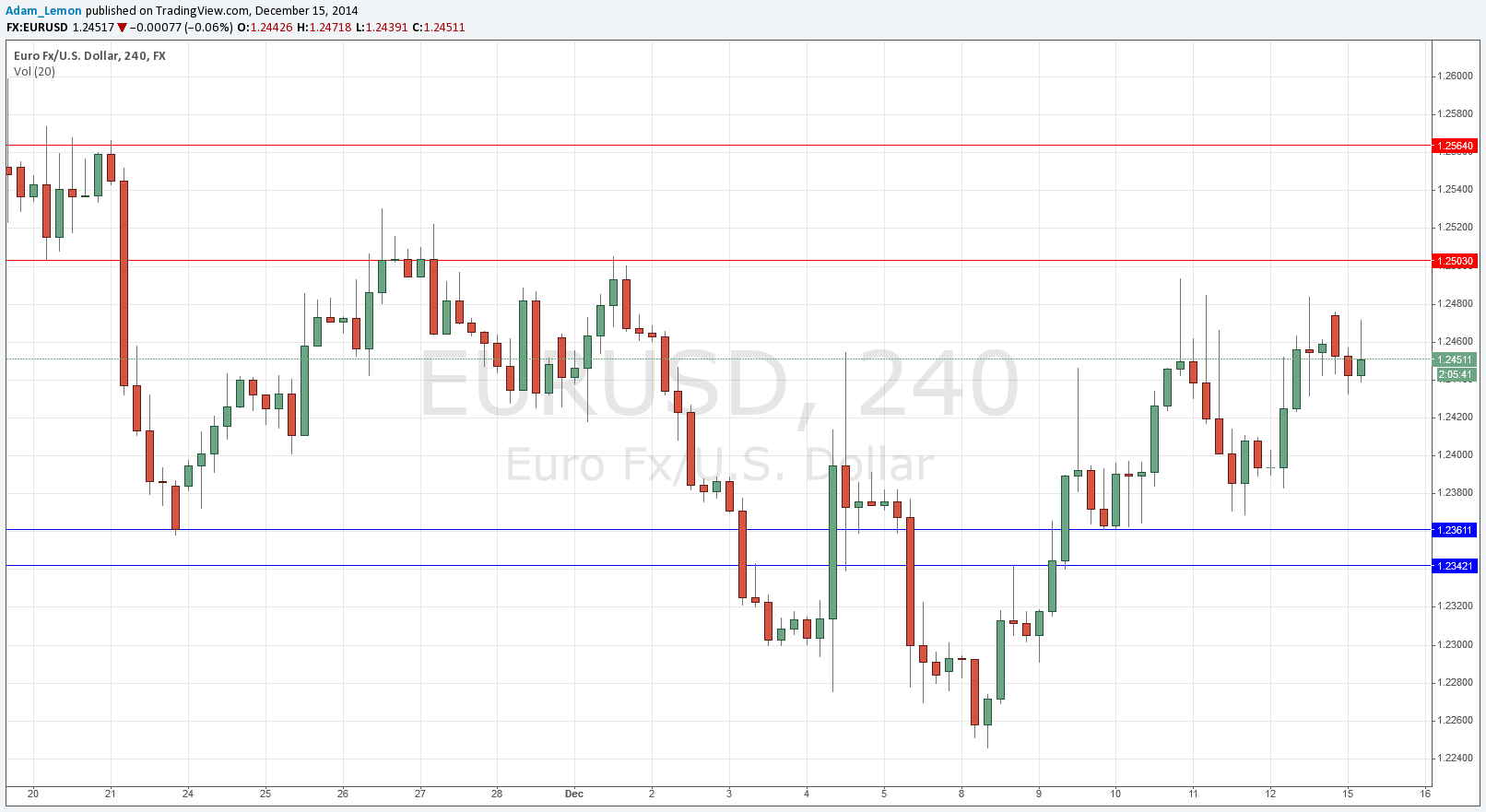

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2503.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2564.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 1.2361.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry after bullish price action on the H1 time frame immediately following the next touch of 1.2342.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Last week closed up as a bullish engulfing candle, the first that there has been for some time. Although this might be an early indication that a move up is beginning, and we have breached a key bearish trend line, we have so far been unable to break above the psychologically key level of 1.2500. When happens at the next serious test of this level is quite likely to determine the direction for the rest of this week.

The support levels below looked minor but developed as very strong and clear flips, so I think they are more significant than they appear. If we hit 1.2361 before 1.2500, it is quite likely to give a bullish impetus for another attempt at 1.2500 so that could be a nice long trade.

There are no high-impact data releases scheduled today directly concerning either the EUR or the USD. It will probably be a quiet day today for this pair.