EUR/USD Signal Update

Yesterday's signals were not triggered as none of the key levels were hit before 5pm London time.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2360.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of the long-term bullish trend line currently sitting at about 1.2175.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

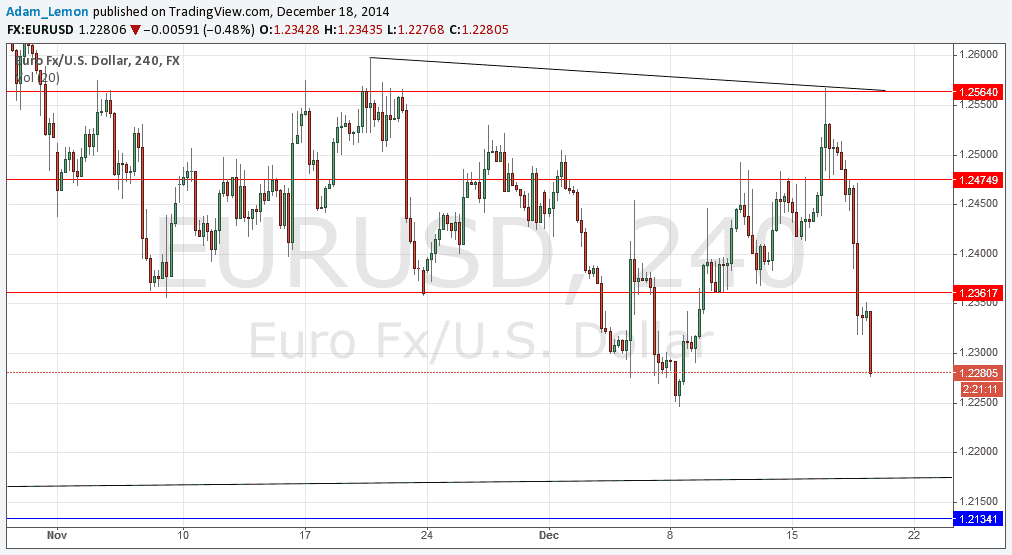

EUR/USD Analysis

I wrote yesterday that it was quite likely that we have already made the high for the week and there is still USD bullishness to play out. This turned out to be correct, as yesterday evening's FOMC events have allowed a continuation of USD bullishness that was particularly evident against the EUR. This pair is now trading close to its multi-year lows, and has broken through a few support levels along the way, so the technical picture has changed.

It is probably that the previous support overhead at around 1.2360 has now flipped to resistance.

There is an extremely significant, multi-year trend line not far below us, shown on the chart below at around 1.2175. This line connects the major lows of he past several years. It doesn't look like a great or perfect trend line formation, but due to the length of time is has been around, it is bound to be significant enough to give some kind of bounce. There is also a key support level below that at 1.2134.

There may also be local support at the recent low of 1.2250.

There are high-impact data releases scheduled today directly concerning both the USD and regarding the EUR. At 9am London time there will be a release of German IFO Business Climate data. Later at 1:30pm time there will be a release of U.S. Unemployment Claims data followed later at 3pm by the Philly Fed Manufacturing Index.