EUR/USD Signal Update

Last Thursday’s signals expired without being triggered as none of the key levels were hit.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm London time.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2360.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2475.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of the long-term bullish trend line currently sitting at about 1.2220.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 40 pips in profit.

Remove 25% of the position as profit when the trade is 40 pips in profit and leave the remainder of the position to run.

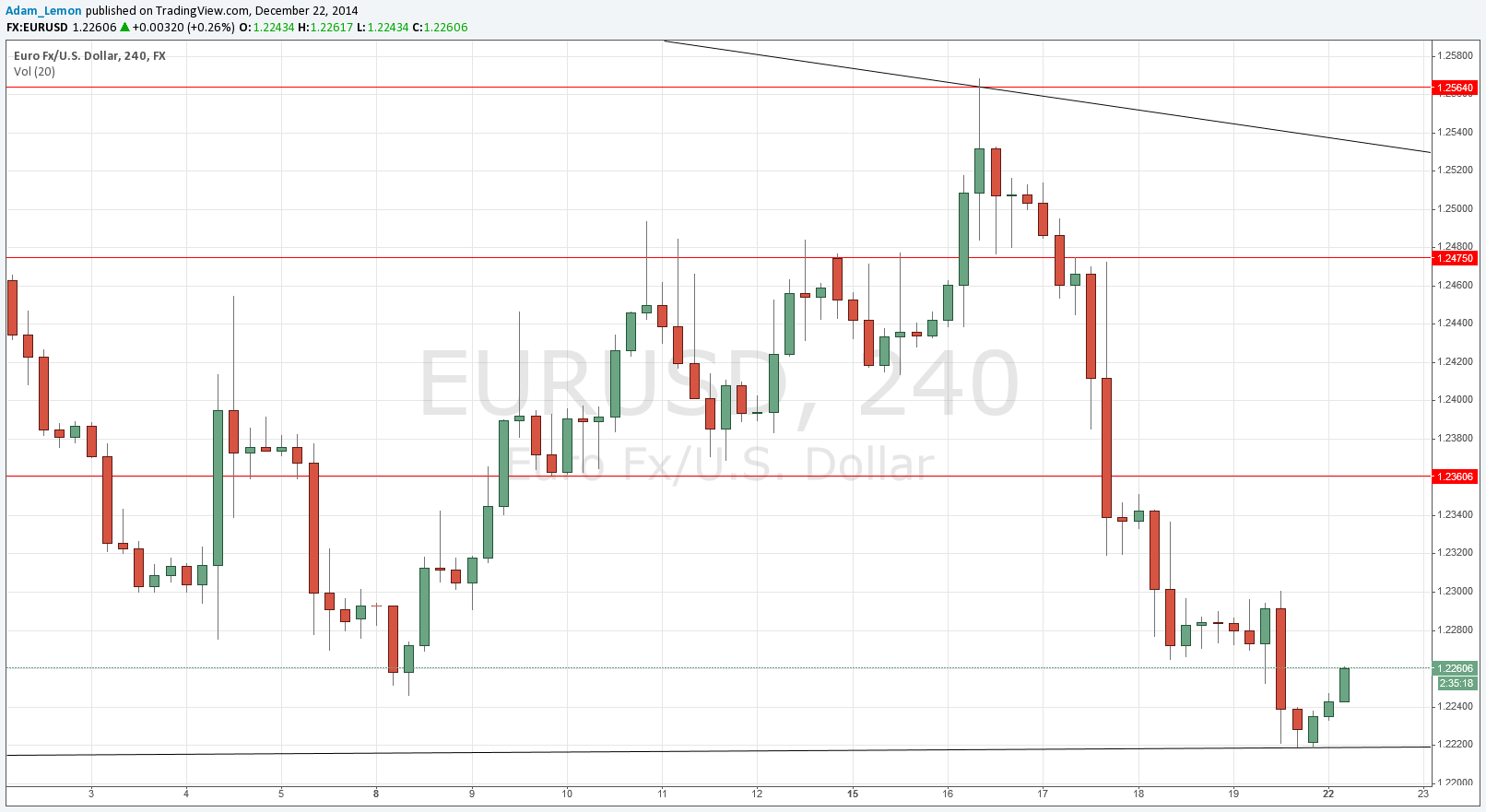

EUR/USD Analysis

At the end of last week I highlighted that the price was approaching a really major, multi-year bullish trend line, connecting the major lows since 2010. This trend line currently sits at 1.2220 and we bounced off it this morning where price reversed to the pip, and it has been coming up ever since. This could be a very significant catalyst for a major pull back or even trend reversal in this pair, so long trades are now becoming very interesting, despite the strong bearish trend and the bearish outside candle that the chart printed last week, which is suggestive of a continued move down.

There is local resistance at 1.2300, but I expect 1.2360 to be more significant and likely to provide a short opportunity. Above that, the next major resistance seems to be located at 1.2475.

It seems probable we will see 1.2360 before we touch 1.2200 next, so the bias today should be long.

My colleague Christopher Lewis thinks a relief rally is quite possible although he expects 1.2050 to eventually be hit.

There are no high-impact data releases scheduled today directly concerning either the USD or the EUR.