EUR/USD Signal Update

Yesterday’s signals were not triggered and expired as none of the key levels were hit before 5pm London time.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered only before 5pm London time.

Short Trade 1

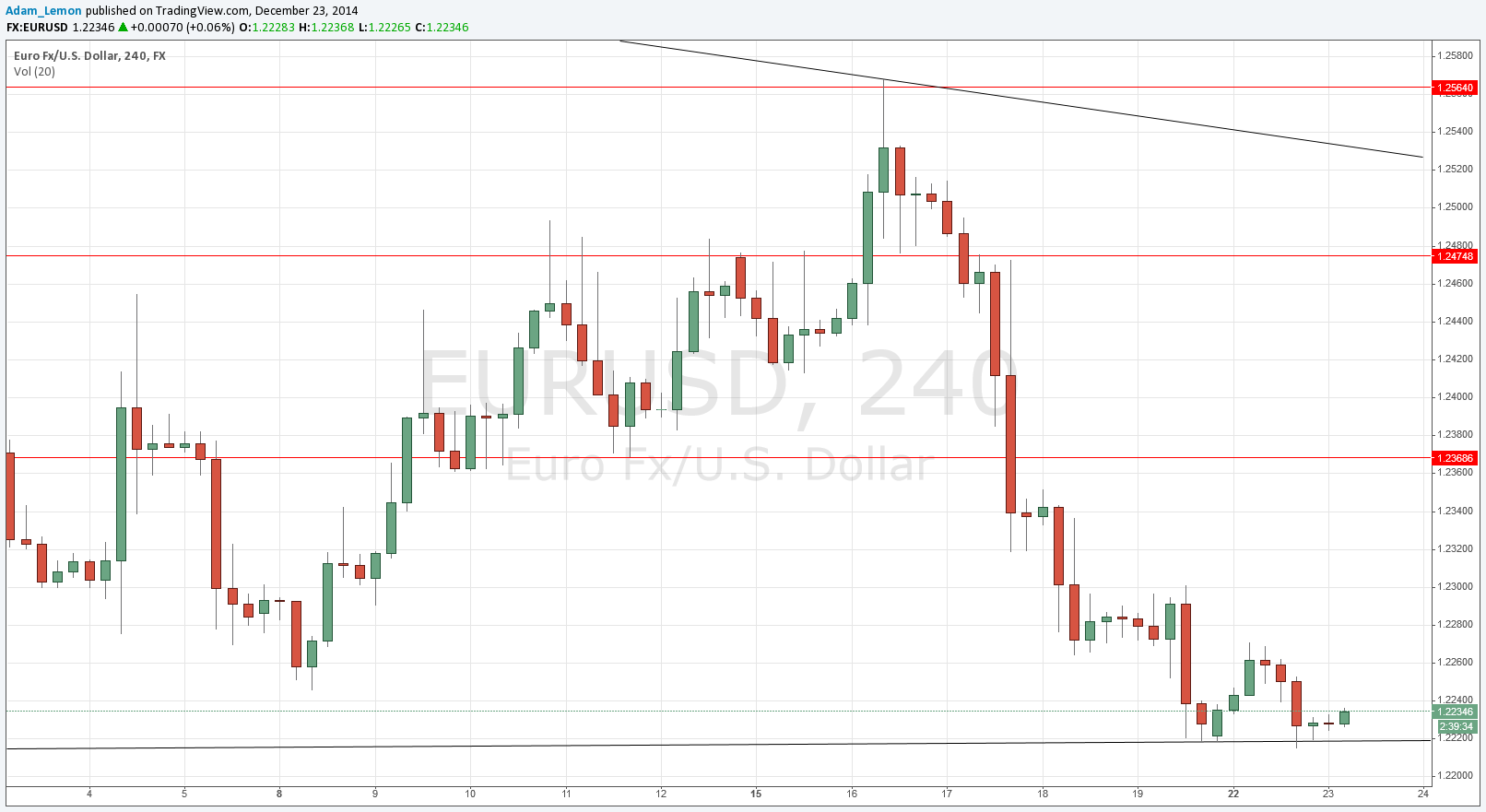

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2368.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2475.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of the long-term bullish trend line currently sitting at about 1.2220.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 40 pips in profit.

Take off 25% of the position as profit when the trade is 40 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

I was expecting the price to rise yesterday after we had bounced up off the very long-term bullish trend line. Although the price did hold up for most of the day it eventually fell and retested the trend line overnight, where it produced another bullish bounce, albeit a small one.

If we are going to move up from here, two tests should probably be enough, so be very cautious about entering a long if we retest the trend line today. Nevertheless, as it is such a long-term trend line, it is worth an attempt at a long-term long trade.

There is resistance above at 1.2368.

There are no high-impact data releases scheduled today directly concerning the EUR. Regarding the USD, at 1:30pm London time there will be releases of Core Durable Goods Orders and Final GDP data, followed by New Home Sales data at 3pm. This pair is more likely to be more active during the New York session than the London session.