EUR/USD Signal Update

Last Tuesday’s signal was not triggered as although the price did hit the trend line at 1.2220, it cut right through it without producing any bullish price action.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be made between 8am and 5pm London time.

Short Trade 1

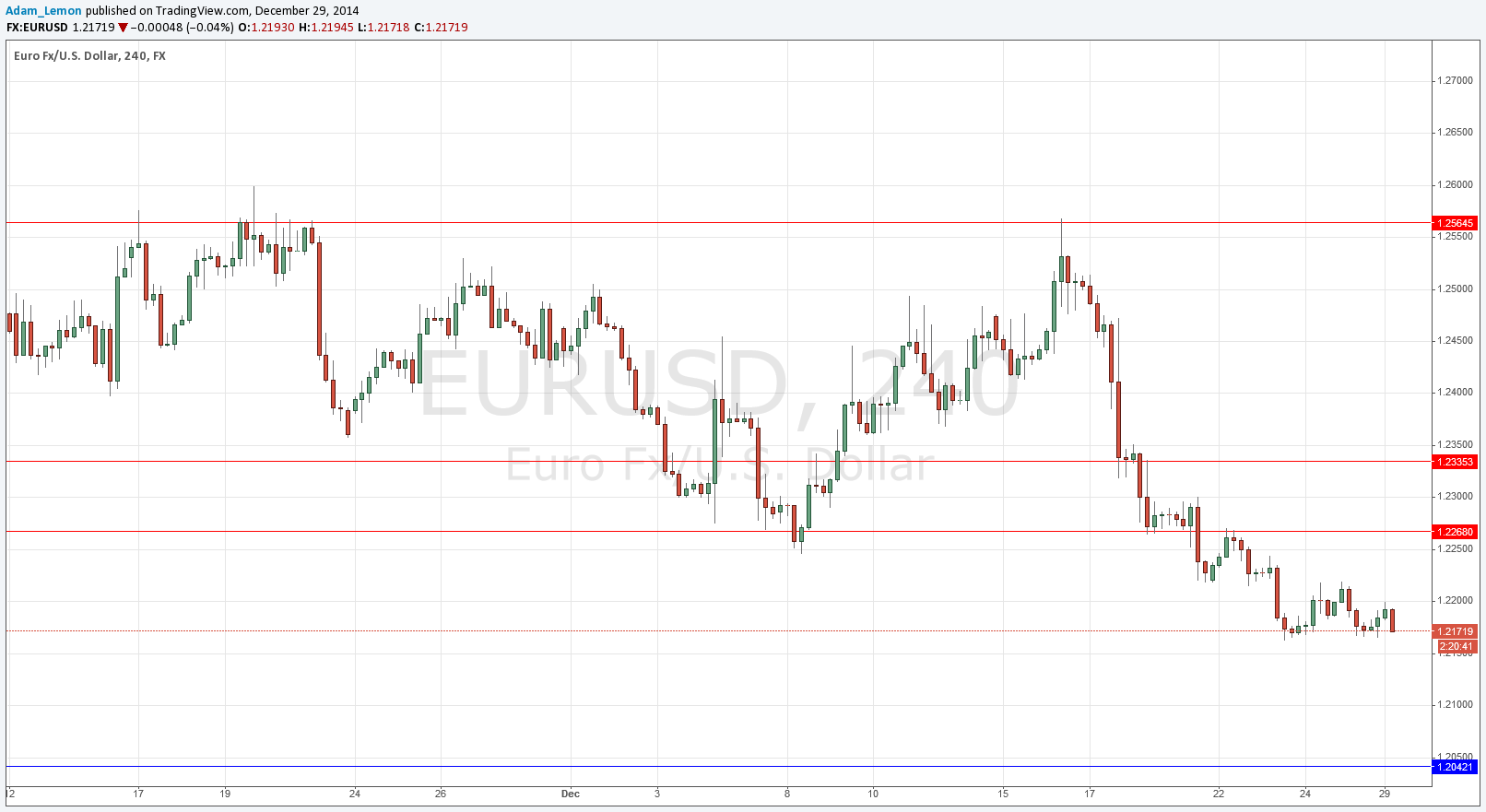

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2268.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2335.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 1.2041.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 40 pips in profit.

Remove 25% of the position as profit when the trade is 40 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

The bullish trend line that I wrote about early last week was, in the end, broken fairly easily. The picture looks bearish and there is no obvious support before a major historical multi-year low at 1.2041.

This has been the kind of December where the dominant trend just keeps on going instead of tailing off, so we might well get further falls in this pair during this week as we close out 2014. The USD is the strongest currency and the EUR one of the weakest, along with JPY and AUD. However today might be a quiet Monday, so do not be in a hurry to take a trade.

There are no high-impact data releases scheduled today concerning the EUR or the USD. It is likely to be a quiet day for this pair.