EUR/USD Signal Update

Yesterday's signals were not triggered. The price did reach 1.2355, but there was no bullish price action there to signal a long trade.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2356.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2375.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 3

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2417.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 1.2275.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

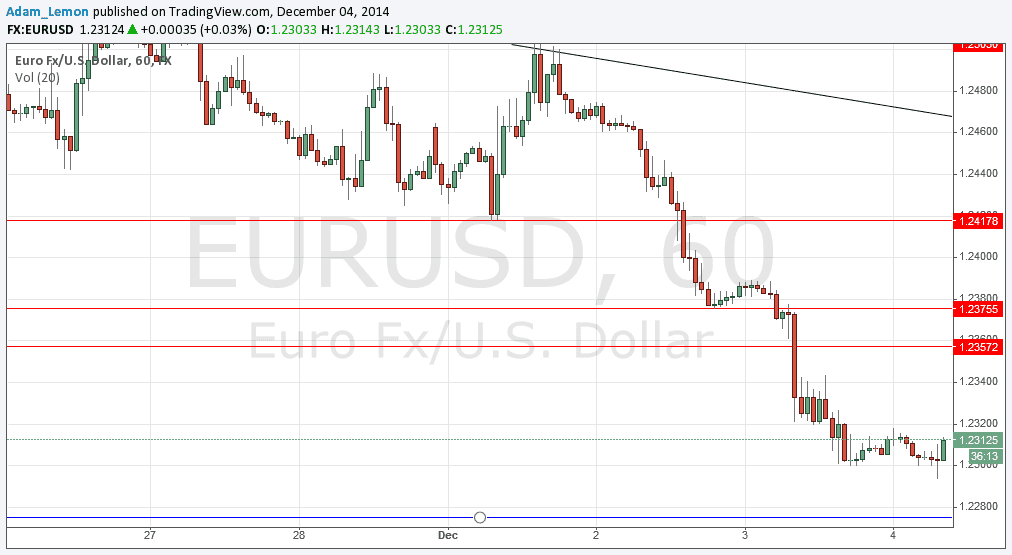

EUR/USD Analysis

I expected yesterday that the lower trend line holding the base of the triangle at 1.2356 would hold before the important news announcements due later today and tomorrow, but I was wrong. We had a bearish breakout below 1.2356 instead. The price has early this morning found local support at 1.2300. The good news is that there should be some good inflection levels above flipping from support to resistance providing opportunities to get short again if the price gets back to them then turns around.

Below us there is old support at 1.2275 which might provide a counter-trend long entry, although it might be we have already seen today's low at 1.2300.

There are high-impact data releases scheduled today directly concerning both the EUR and the USD. Regarding the EUR, there will be a release of the Minimum Bid Rate at 12:45 London time followed by a press conference from the ECB at 1:30pm. Regarding the USD, there will be a release of Unemployment Claims data, also at 1:30pm. It is likely to be volatile from about Noon.