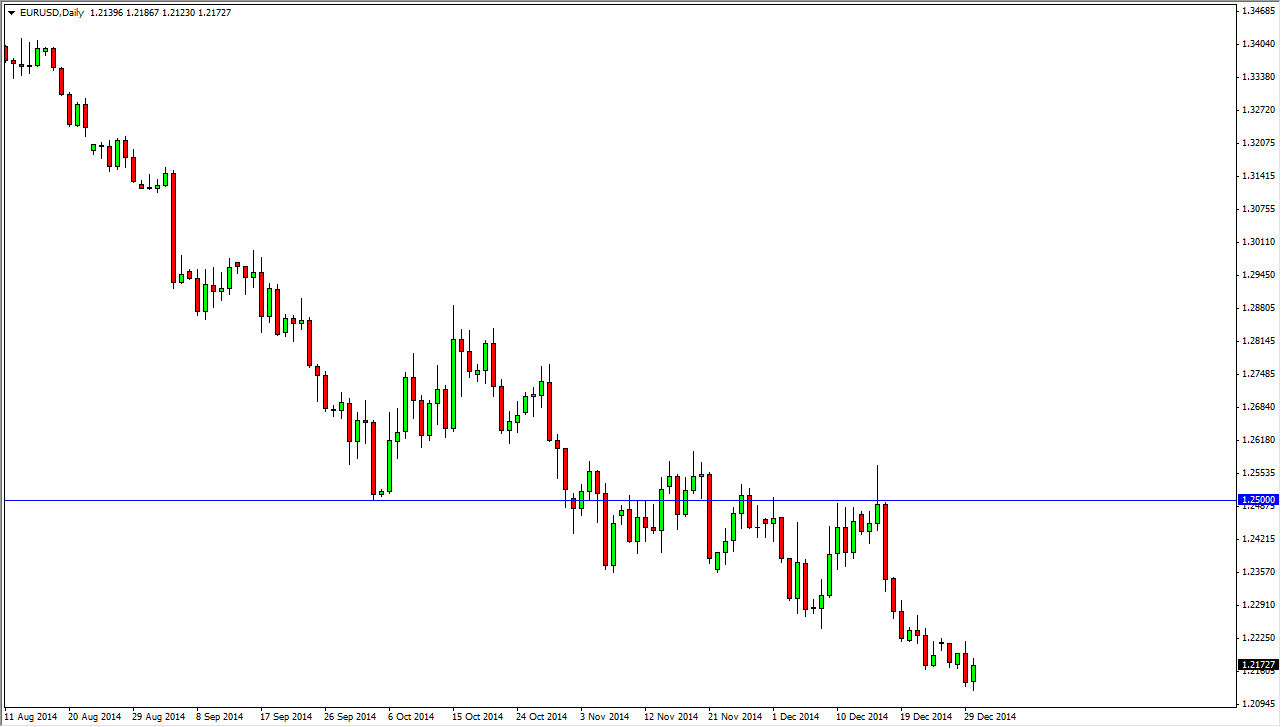

The EUR/USD pair broke higher during the course of the day on Tuesday, but at the end of the day we do not have much in the way of clarity. When I say that, I mean for the ultra-short-term. I don’t mean for the longer term, for myself, I believe that we go down to the 1.2050 region. I think it does rally from there, but in the meantime I think rallies offer selling opportunities until we actually test that region.

I think that the Euro is starting to get way oversold, and I also recognize that the 1.20 region is the massive supportive area on the monthly charts that the markets have bounce from over the last several years. With that being the case, the market looks as if it will offer trading opportunities time and time again of the next several sessions, but I believe they will be of the shorter-term variety because of the lack of liquidity, and of course the holiday itself.

Looking to the longer-term charts

I believe that looking to the long-term charts is going to be a massive necessity when it comes to figuring out where the market goes next. I think that as we approach the 1.20 region, this pair is going to become extraordinarily noisy, so I am going to continue to look at it from a shorter-term perspective. As we stand right now, I am only selling. The closer we get to the 1.20 level however, I would actually start to consider building a large long position.

The one caveat of course is if we close below the 1.20 level on a daily candle. If we do that, then I think the bottom falls out and we go to the 1.18 level given enough time. The 1.2050 level is a complete “round-trip” of the uptrend that is now history, so that is why I have it as the first target. I love the scene short-term rallies that I can fade, as I believe the US dollar will continue to be strong for the short-term but it’s the Euro that is most certainly oversold.