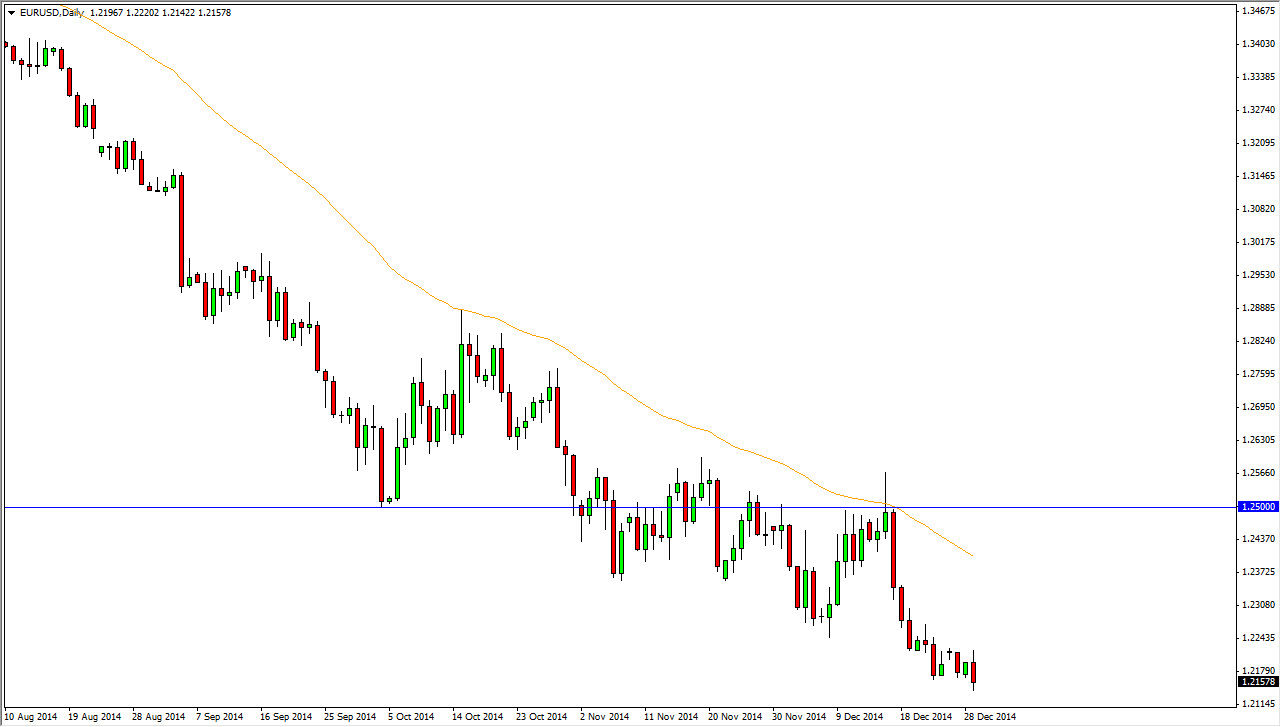

The EUR/USD pair fell again during the session on Monday, after initially trying to rally. As you can see the trend has been intact for some time, as denoted by the 50 exponential moving average on this daily chart. That being the case, I see no way in which I would be buying this pair, even though it does look a little bit overextended to the downside at the moment. With that being the case, bounce could come but I’m not looking to buy that, I think that is simply going to offer value in the US dollar. In other words, let this pair bounce: it’s only going to offer another selling opportunity as far as I can see.

I believe that the market then comes lower to the 1.2050 level given enough time, as it is the beginning of the uptrend that we have completely decimated now. With that being the case, it’s only a matter time before this thing falls apart. Can it get below there? Of course again, but truthfully I think we are starting to get into the very latter part of the downtrend.

Continue to buy the US dollar

The only thing I can do right now is continue to buy the US dollar. I have no interest in selling it against any currency, and although the Euro is probably a bit oversold at this point in time, I certainly wouldn’t sell the US dollar against the Euro, or in other words - buy this pair. I think that the problems in Europe will continue to work against the Euro going forward, but I cannot help but notice that the 1.20 level is a massive floor in this market on the monthly timeframe. With that being the case, I have to believe that the area will again attract buyers as the Euro would be extraordinarily cheap.

Ultimately, I think that we have selling opportunities for a little while, and I will be paying a lot of attention to the longer-term charts about 100 pips below here, because I think we may get a nice reversal signal for the longer-term play.