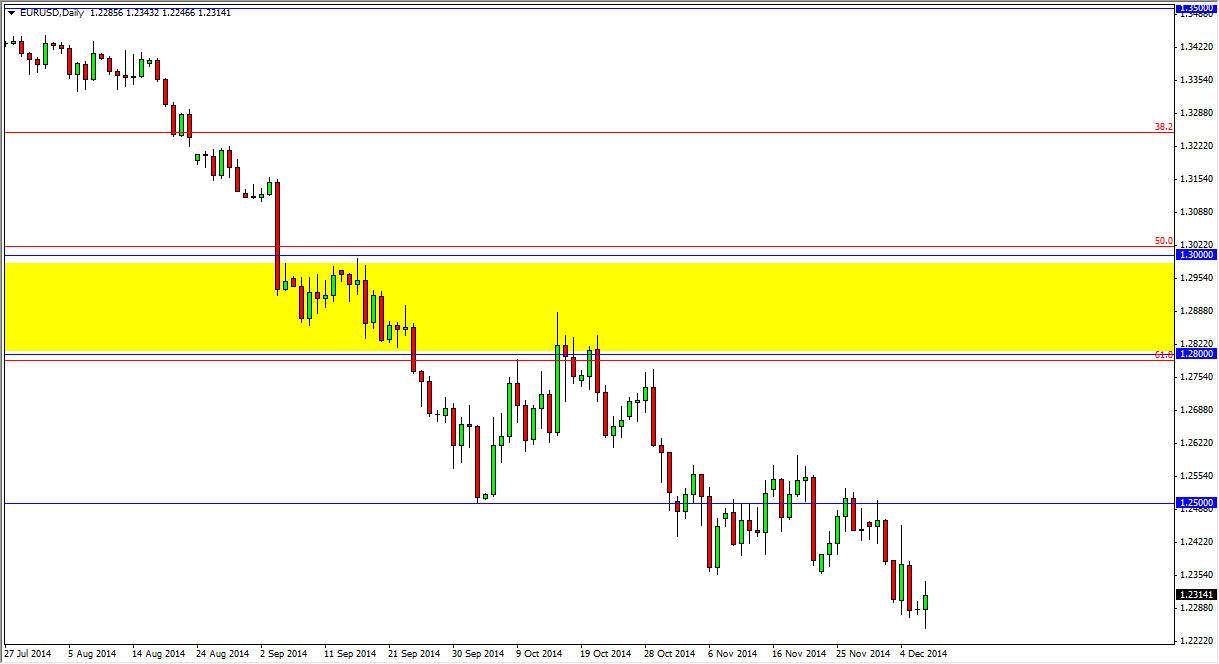

The EUR/USD pair showed signs of life below the 1.23 level during the Monday session as we turn things back around and form a little bit of a hammer. That being the case, it looks as if the market is ready to continue bouncing a little bit in this particular area, but ultimately we feel that it’s only a matter of time before the market runs into resistance yet again. After all, the market is in a nasty downtrend as the US dollar is by far the most favored currency in the world.

I believe ultimately that this market will continue to show weakness again and again, as the market sells off over the longer term. I believe that the 1.2050 level will continue to be the target going forward, and I also believe that there are several areas above that will offer massive resistance. Ultimately, I think it’s only a matter of time before the sellers step in every time we rally.

Downtrend is strong and with good reason

The downtrend in this pair is strong and with good reason as far as I can see. I don’t see any reason whatsoever for the US dollar to be sold in general, and that’s going to be especially true when it comes to trading it against the Euro. After all, the European Central Bank should continue to be very weak with its monetary policy, as the European Union continues to struggle with growth.

It’s not until we get above the 1.30 level that I would even consider buying this pair, and quite frankly I just don’t see that happening. With that being the case, the market should continue to be one that we can sell again and again, every time a rally show signs of weakness. Ultimately, I believe that this is a trend that you continue to sell over and over until further notice. In fact, I think that the later we get in the year, the lower this pair will get. Ultimately, the Euro is probably one of the least favorite currencies out there right now.