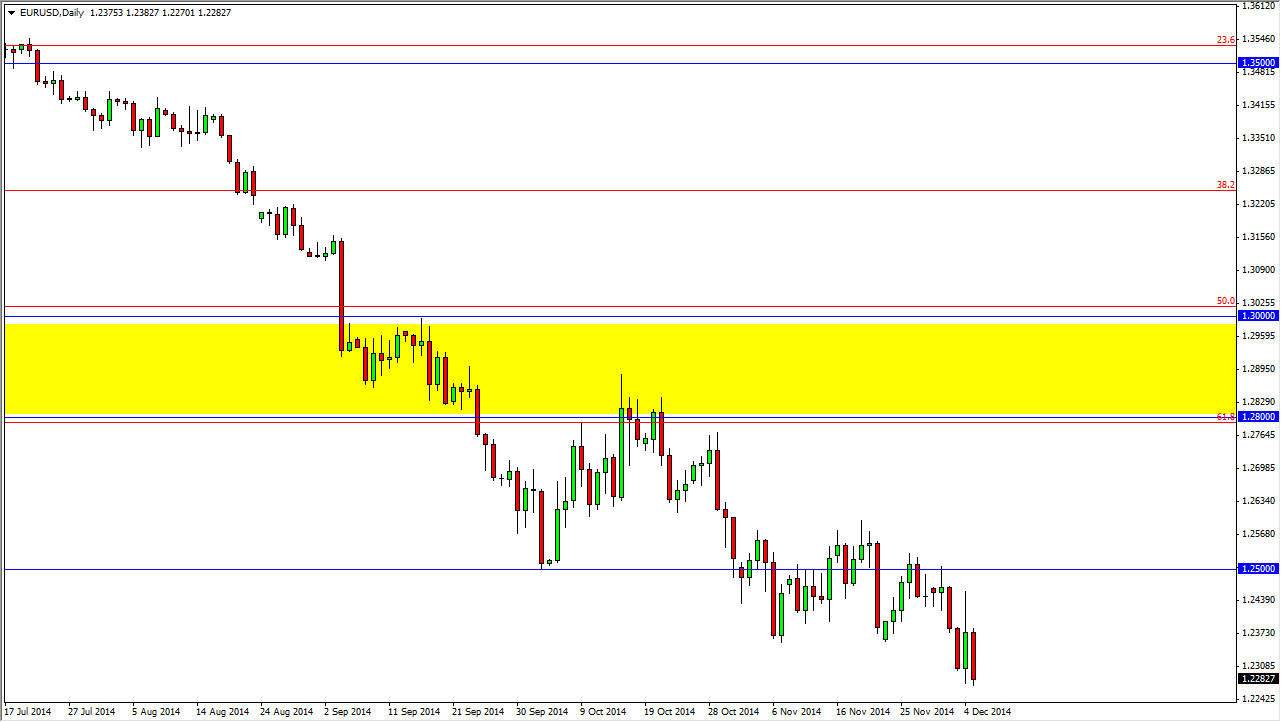

The EUR/USD pair fell during the session on Friday, as the nonfarm payroll numbers came out better than anticipated. Because of that, more and more money flows back towards the United States, as the European Union continues to struggle. It makes sense, as the financial stability of the United States is much more preferable to a Europe that seemingly cannot get out of its own way in some sectors. With that, I believe that the European Central Bank will have to step into the marketplace and expand its monetary policy, which of course will bring down the value of the Euro in general.

Looking at the candle for the session, it is apparent that we will continue to go lower, and as a result I am more than willing to sell this pair on a break of the bottom of the candle. I think that signals continuation, and should drive this pair back down to the 1.20 level next. I think rallies at this point time of course aren’t necessarily something that you can believe in either, as the market will continue to bring in sellers into play as they will look at rallies as value in the us dollar.

Downward continuation

I believe that the downtrend should continue for the foreseeable future, and should extend into the year 2015. I recognize that the month of December can bring in a lot of flaky volatility, mainly based upon lack of liquidity. However, I believe that any massive rally during the month of December will be simply profit taking, and will offer value in the US dollar going forward into the month of January. I look at those as simple gifts, as those of us who are smaller traders can lately tread the markets underneath the movements of elephants known as hedge funds and banks.

It is not until we break above the 1.30 level, or the yellow box on this chart that I would consider buying this market as it would then be a trend change in my opinion. With that being the case, I see myself selling this pair again and again and again.