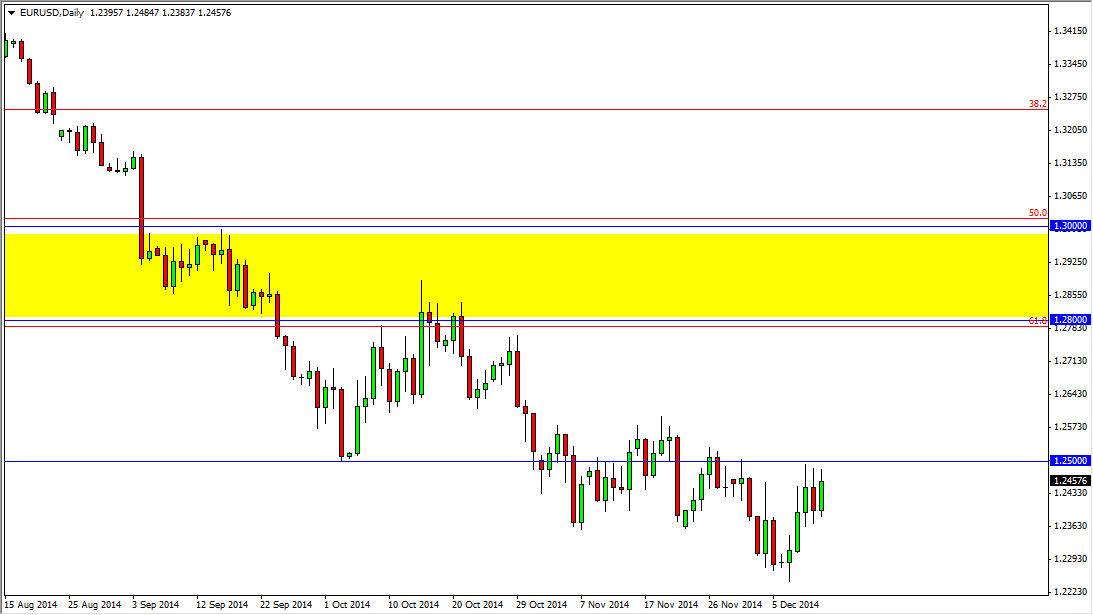

The EUR/USD pair rose during the course of the session on Friday, but struggled at the 1.25 handle yet again. This is an area that has served as resistance time and time again, and I am not surprised at all to see that the market failed there. Quite frankly, I think that the market will continue to sell off in that region, probably going all the way up to the 1.26 level in the immediate future. I am looking for short-term candles in order to take advantage of value in the US dollar as it is without a doubt the favored currency by Forex traders around the world.

Ultimately, I think this pair will return to the 1.2250 level, and short-term candles could lead the way. The wrong, I would prefer to see daily candles that very soft, but at the end of the day you have to take which are given. On top of that, we are starting to head into a very soft part of the year as far as liquidity is concerned, and that of course will play havoc with this market. It’s very likely that we will see very erratic motions from time to time, as short covering continues while money managers trying to bring home profits for their clients.

Continue downtrend into 2015

I believe that the downtrend continues into 2015, and that anytime this market rallies it is an invitation to start selling again as we certainly have broken any of the last vestiges of an uptrend quite some time ago. In fact, I don’t think it’s until we get above the yellow rectangle on the chart the week even consider going long, and that is the 1.30 handle. In other words, it’s a long way above year and it’s very unlikely that we are going to see that move anytime soon. I will look to the longer-term chart for possible supportive candles and signs that the trend is ending, but I don’t anticipate seen that anytime soon as the market has clearly stated its preference for the greenback.