Quantitative Forecast

Academic studies have shown that the most reliable way to determine future price movements from past price movements, is by use of momentum.

In the Forex market, a momentum study is best applied to the four major Forex currency pairs by simply checking whether the weekly close is above or below the weekly close 13 weeks ago.

If the price is higher, the statistical edge is in trading that pair long.

If the price is lower, the statistical edge is in trading that pair short.

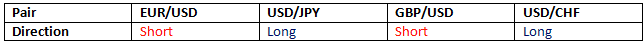

On this basis, the quantitative momentum forecast for the edge during the coming week is as follows:

Technical Forecast

The question as to whether an experienced chart-reading technical analyst can outperform a simple momentum model warrants a live experiment. Looking at the weekly charts for each of the four major pairs, I will try to determine the line of least resistance, and forecast the directional edge using my own technical analysis.

On this basis, technical analysis forecast for the edge during the coming week is as follows:

All of the major pairs closed at new, long-term highs on the USD side.

All of the major pairs are moving the same direction (long USD).

All of the Japanese candlestick formations on the weekly charts show a bullish USD.

Summary

Both the quantitative and technical forecasts agree completely.

Next week, we will review how these forecasts performed.