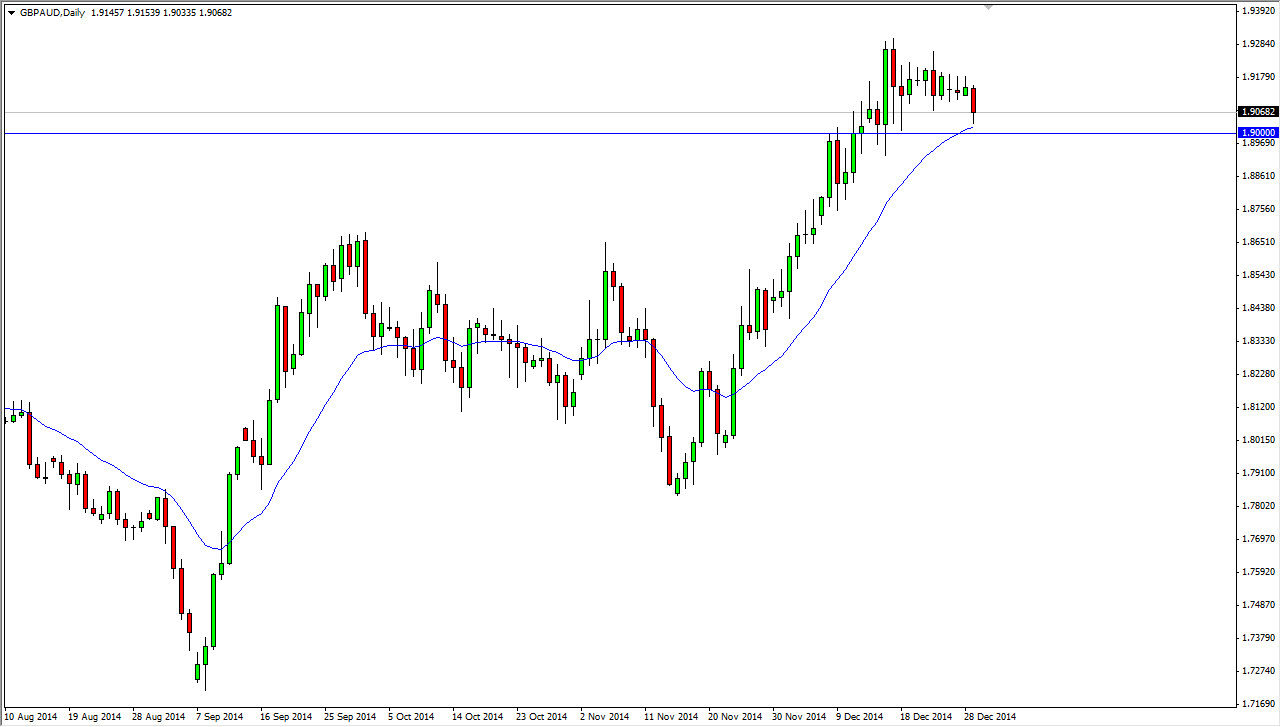

The GBP/AUD pair fell during the session on Monday, but as you can see on the chart found a bit of support. I have the 1.90 level marked on the chart, and you can see that it has in fact offered support several times in the past. Because of that, and the fact that the number is a large round number, I believe that the market will see buyers step in.

On top of that, I have the 20 day exponential moving average plodded on the chart as well. You can see that the market has climbed quite nicely over the last couple of months, and that the 20 EMA has been relatively indicative of where the trend is going to go once we decided to go higher. The question now is whether or not the 1.90 level is important enough for the buyers to pay attention to.

Australian dollar weakness

I believe that the Australian dollar and its weakness will continue to push this pair higher. That being the case, the market should continue to go higher given enough time, as although the British pound is falling against the US dollar, the truth of the matter is that the British pound itself is doing better than the Australian dollar, and quite frankly that’s all that matters as it is a measure of relative strength after all.

Gold markets are doing absolutely no favors for the Australian dollar either, so having said that I believe that this market continues to go higher given enough time. If we get some type of supportive candle, I am willing to start going long, and I would even do so on short-term charts. I think that the volatility may die down a little bit over the next 48 hours or so, but quite frankly that’s not that big of a surprise.

Ultimately, even if we broke down below the 20 day exponential moving average, I am still a buyer all the way down to the 1.85 level on supportive candles. The Australian dollar is simply far too weak to buy.