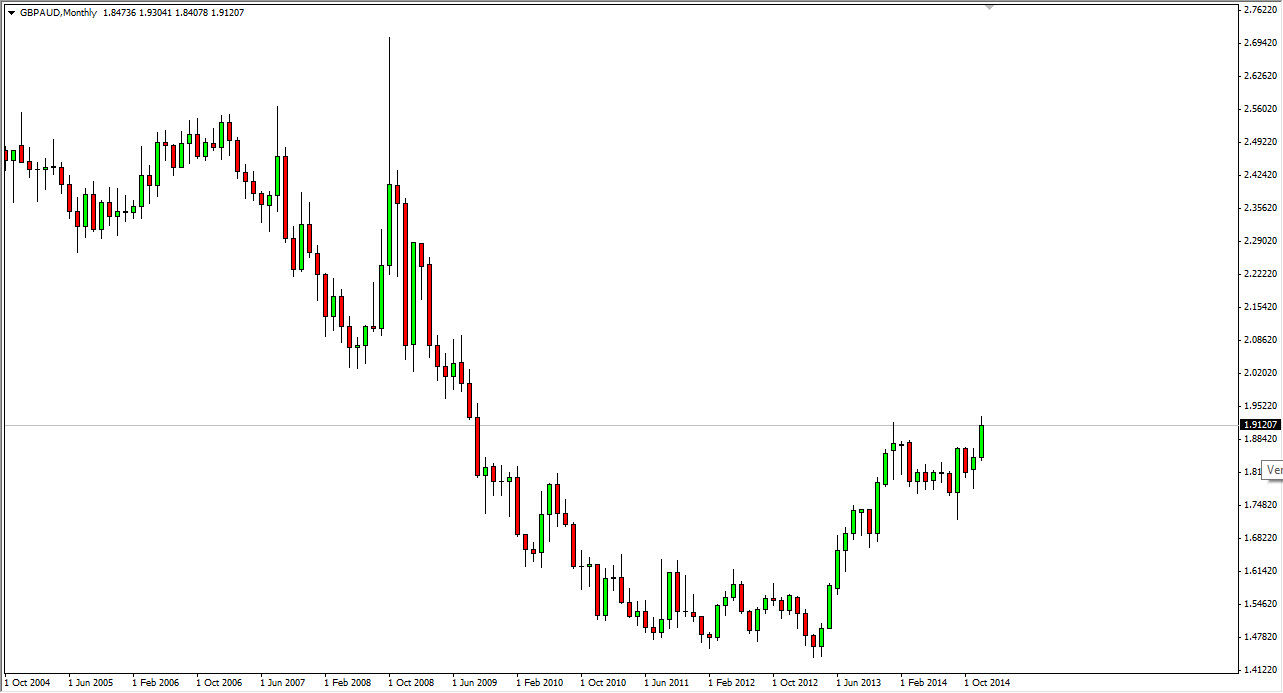

The GBP/AUD pair broke higher during the course of the month of December, clearing the 1.90 level with significance. That being the case, it appears that the pair is ready to continue going higher as we have recently broken out of significant consolidation. In fact, I think that the market looks as if it’s ready to continue going all the way to the 2.0 level without too many issues, and that’s exactly where I believe we will end up at by the end of the quarter.

Looking at this chart, even if we do pullback, I believe that this market should find plenty of support below, and as a result I am bullish of this pair for the longer term. In fact, I think this market will continue to go higher beyond the end of the first quarter, as the market certainly looks like it’s made up its mind, and the Australian dollar continues to look very soft. On top of that, the British pound looks like it’s ready to bounce against the US dollar sometime in the relatively near future. With that being said, it’s likely that the combination of the two should send this market higher.

Continued bullishness

The continued bullishness could make this a “buy on the dips” marketplace going forward, so I think longer-term traders will continue to push this market to the upside. That being the case, the market should continue to be one that trend traders do well with, and that people continue to go to again and again to the upside. I do recognize it somewhere around the 2.05 level there will be a significant amount resistance as it was once supportive, but I don’t think really get anywhere near that during the first quarter.

With that being said, this is a pair that I plan on being involved in time and time again during the course of the quarter, and with that being the case I don’t see any reason to think that the market will behave any differently.