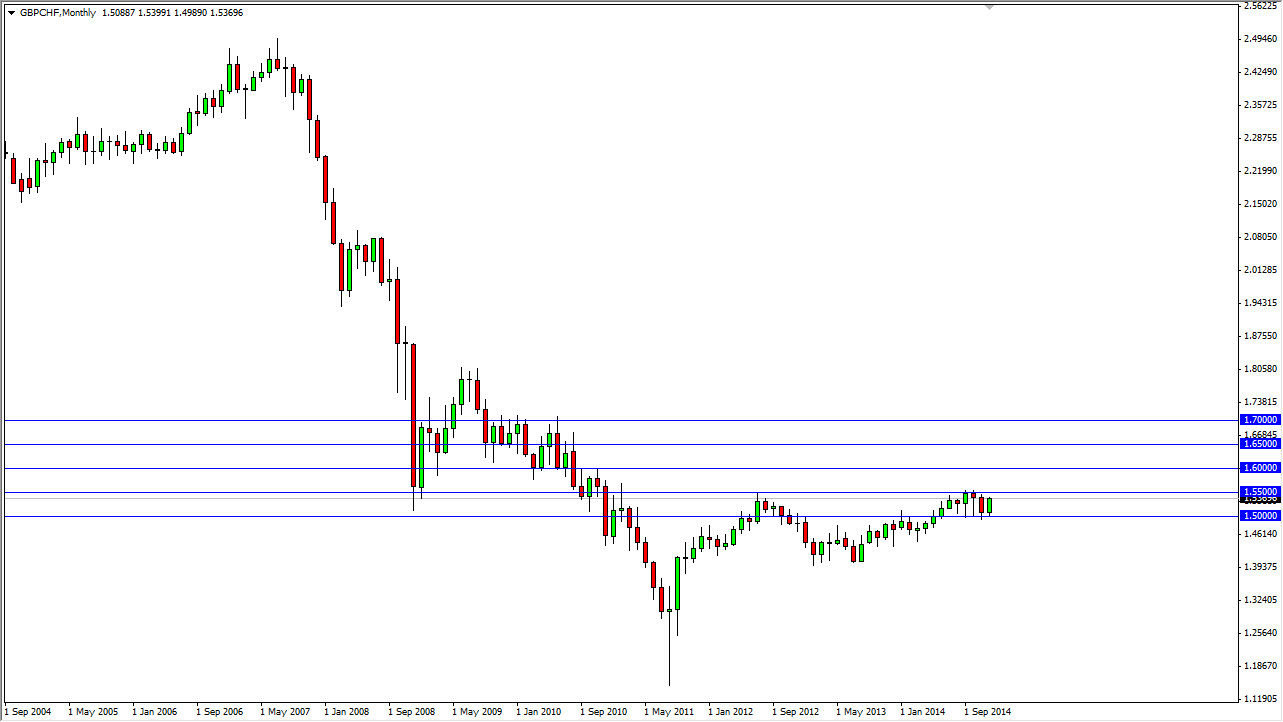

The GBP/CHF pair is one that very sensitive to risk appetite, and with that I feel that you’re going to have to watch the stock markets in general to see whether or not this pair should go higher. I think that the 1.55 level will in the end be very crucial, but it’s probably only a matter of time before we break above there. You can see on the chart that I have clearly marked out the next 500 pips lines, again and again. With that, you can see how this market may grind higher, but ultimately I think that if we can get above the 1.55 level, it should be a market that you can buy every time it dips.

As far as I can see, this market will more than likely head to the 1.70 level by the end of the year, but I expect a lot of volatility. The British pound has been oversold but it is starting to look like it might pick up a little bit of support against the US dollar, and as a general rule, that means that the British pound should do better against other currencies as well.

Longer-term outlook positive

Don’t get me wrong, although I’m positive I do recognize that there is a certain amount of volatility just waiting to happen in this marketplace. I think that looking to the daily or weekly chart based upon these 500 pips lines is probably going to be the best way to trade this market and see some type of clarity going forward. I think that the 1.50 level will be massively supportive, and as a result I don’t really have any interest in selling this market at all. Besides, it’s likely that the Swiss franc will be sold in general during the year 2015, as the Swiss National Bank is very likely to do what it can to keep the value of the Swiss franc down. With that being the case, I think that buying makes a lot of sense in this particular market.