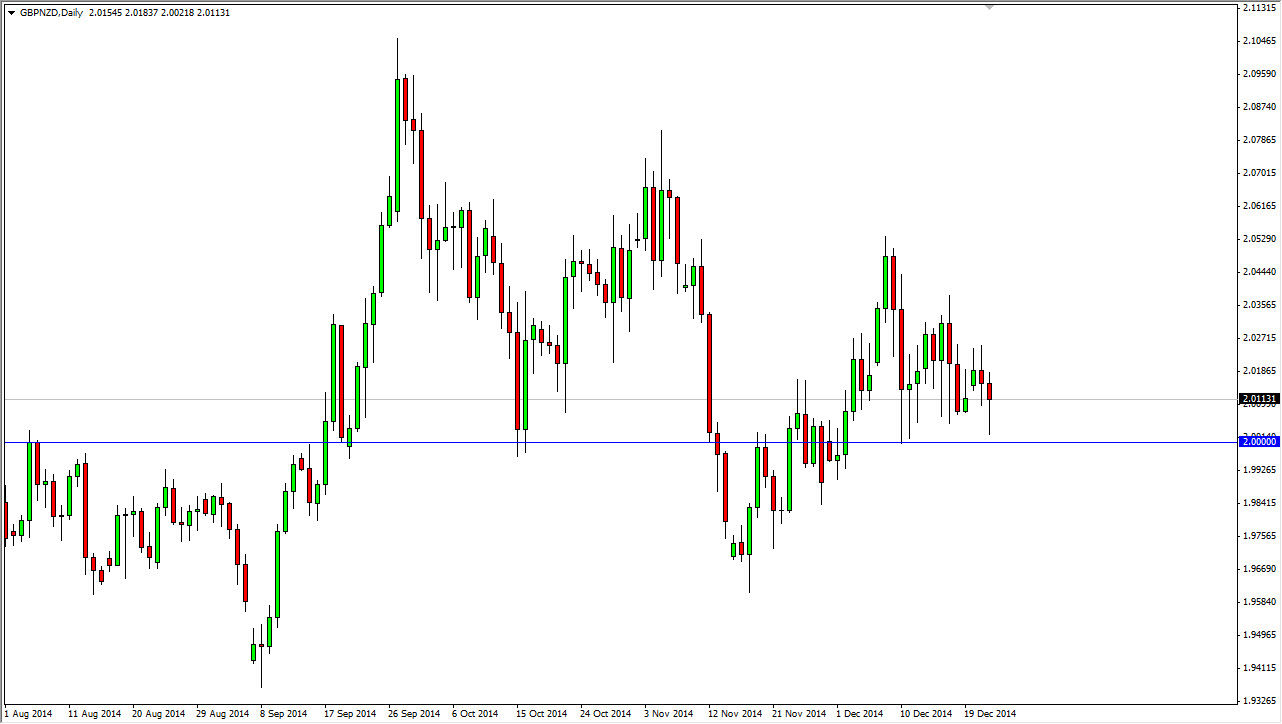

The GBP/NZD pair fell during the bulk of the session on Tuesday, but as you can see found plenty of support at the 2.00000 handle. With that being the case, the market looks as if the buyers are stepping in and that the “2” level is in fact one that the buyers are willing to support. Because of this, I feel that this market will more than likely grind its way back to the 2.05000 level, but there might be a bit of a fight between here and there. Don’t give a wrong though, I think that the longer-term will certainly prove itself to be positive, and we will go above there given enough time as well.

I also recognize the two level to be a major psychological barrier, so it makes sense that we would have buyers there. Ultimately, I think we could go as high as 2.10000, but that of course is going to take some serious time. When you look at the two currencies, the British pound might be a bit on the soft side, but the New Zealand dollar is being actively worked against by the central bank in Wellington.

Royal Bank of New Zealand

The Royal Bank of New Zealand has recently stated that they need to see the NZD/USD pair down at the 0.68 handle. While that doesn’t translate perfectly into this marketplace, you should know that the NZD/USD pair is at roughly 0.76 at the moment. Because of this, the New Zealand dollar needs to lose value in general, and that should send this pair higher by default. On top of that, the British pound although being a bit soft at the moment, certainly is stronger than the New Zealand dollar going forward in you are simply measuring relative value at this point in time. I don’t see any reason why this pair will continue to go higher given enough time, and therefore I am bullish for at least 500 pips, if not 1000. I have no interest in selling this market.