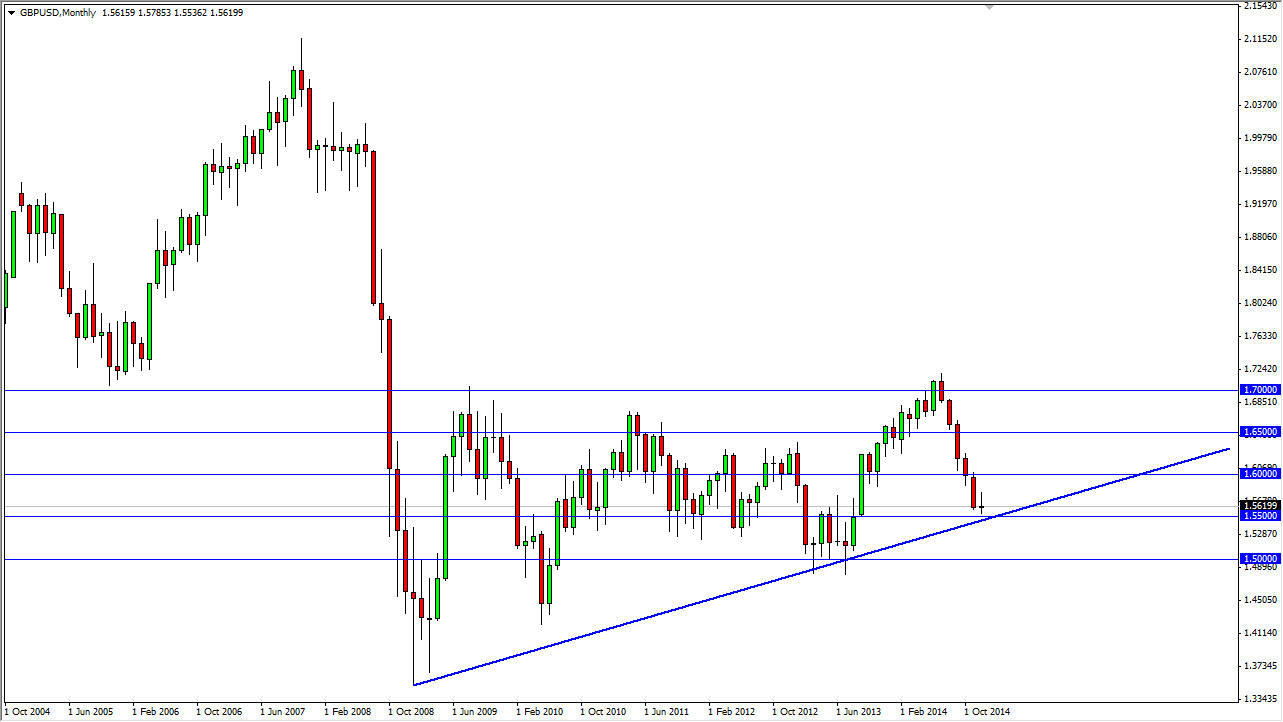

The GBP/USD pair initially tried to rally during 2014, but found the 1.70 level to be a bit too resistive, and then suddenly fell off of a cliff from that point in time. With that being the case, we are now approaching what I have drawn on the longer-term charts as a bit of a sloppy trend line, which intersects with the 1.55 handle. As I write this article, it is the middle of December, so I would anticipate that the exchange rate would be fairly close to what you are looking at.

With that being the case, I think it comes down to this trend line. If we break down below the trend line, I feel that we then go to the 1.50 level where we should find plenty of buying pressure. On the other hand, if we bounce from this trend line, I think we will spend the majority of 2015 going higher. Just simply continuing the longer-term gentle slope higher that we have seen for several years now.

A channel of sorts

We have been trading in a channel of sorts since 2008, and I think that’s going to continue to be the case. Some type of supportive candle would be helpful near the 1.55 handle, but at that point time I think it’s only a matter of time before you go higher, probably reaching as high as 1.70 get before the end of the year. In fact, you can almost suggest that this upward channel is more or less an ascending triangle as well. Either way it’s positive. I don’t have any interest in selling this market anymore.

It will be interesting see what happens, but I think longer-term traders are going to assist we approach this marketplace with a “buy-and-hold” type of attitude. Ultimately, I do believe that we break out above the 1.70 level given enough time, but the question is whether or not we can do it during the year 2015? I think that’s very possible to be honest as the market is most certainly oversold at the moment.