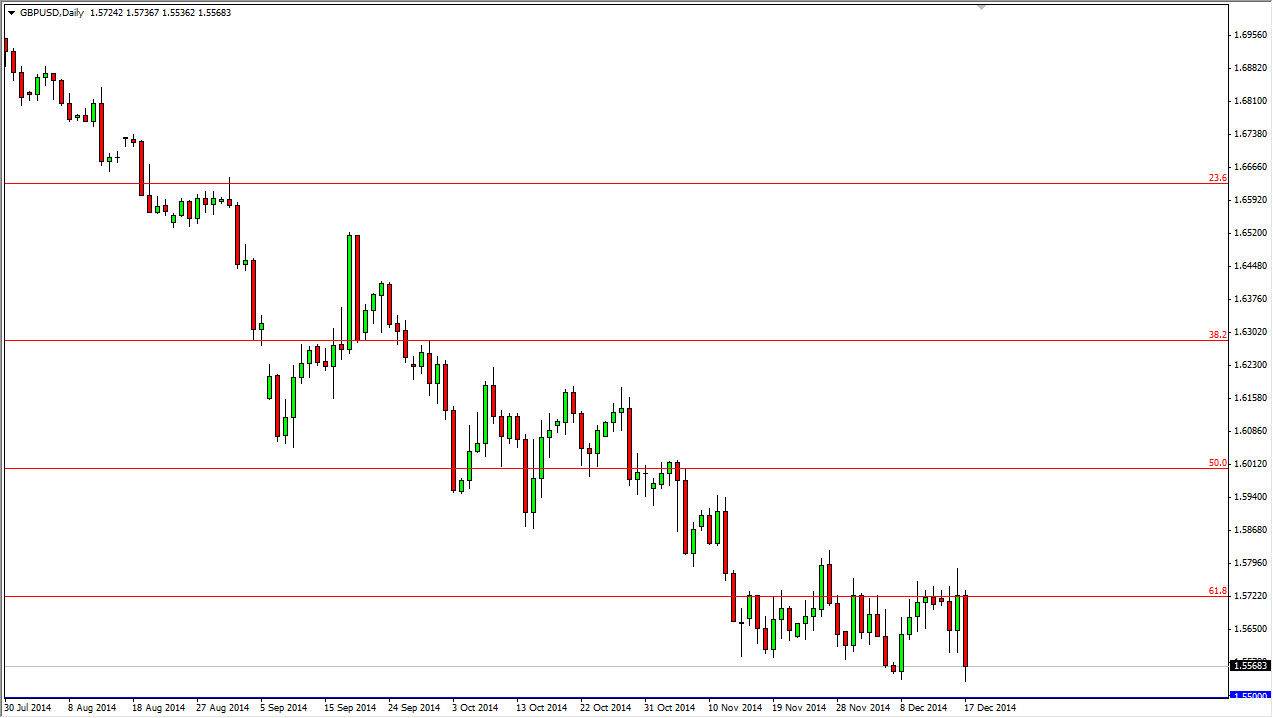

The GBP/USD pair broke down during the course of the session on Wednesday, but we remain above the 1.55 handle. Because of this, I am not ready to start selling this pair but I do recognize that a move below the 1.55 level is indeed very bearish and it should continue the downtrend heading down to the 1.50 level which of course is a massive round number. I think that this is more or less a statement on the US dollar instead of the British pound. With that being the case, I know that the US dollars favored by most traders around the world, and that of course isn’t going to be any different in this particular marketplace.

I have no interest in buying this market at the moment, and in fact I’ll think the trend changes until we get well above the 1.60 handle, which of course looks very unlikely at this point. I believe that the consolidation that we’ve been in for some time now should continue to be the norm, except the aforementioned break down below the 1.55 handle. If we get that, I would be massively short of this market.

It’s all about the greenback

At this moment time in the Forex markets, it’s all about owning the US dollar. I think that really is what’s going on in this pair although Great Britain of course is heavily reliant on exports into the European Union, which is a necessarily the greatest thing to have on your side right now. With that being the case, I believe that we do see continued weakness and I would be willing to sell short-term rallies as long as we stay below the 1.60 handle. I need to see resistive candles, but that shouldn’t be that hard find quite frankly.

In a world where quantitative easing seems to be the norm, the Federal Reserve of course is the one major outlier. With that being the case, I think the US dollar continues to strengthen and we will see this pair hit the 1.50 level sometime in the course of the next month or so, which keeps me bearish.