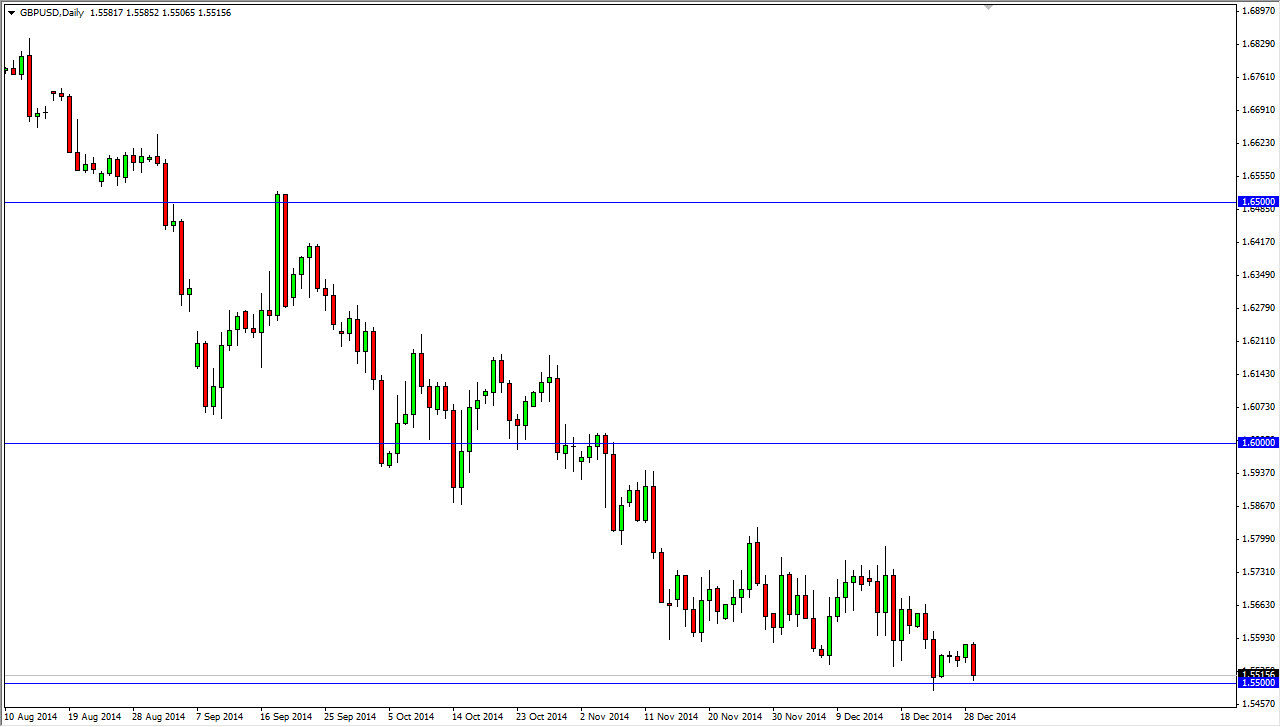

The GBP/USD pair fell hard during the course of the session on Monday, testing the 1.55 level again. This is an area that has been rather supportive for some time, but quite frankly I feel that it’s only a matter of time before we smash through this barrier. In fact, I think that will probably happen today or tomorrow. Once we get below the 1.55 level on a daily close, I don’t see any reason whatsoever why this market could go to the 1.50 level sooner or later, as it is the next major support level.

However, you have to keep in mind that the area below the 1.55 level has a lot of noise in it, so it won’t surprise me if we bounce around quite a bit. If we break down, I think that it’s one of those situations where you will get several different opportunities to sell this pair. In fact, it may become a short-term type of pair as it offers plenty of selling opportunities time and time again. That will be especially true considering that the markets are going to be dealing with low liquidity, meaning that we will probably have very shallow movement over the next several sessions.

This is about the US dollar

This is a necessarily by the British pound in my opinion, I think this is more or less about the US dollar. After all, the British pound is in doing that bad against many other currencies, but the US dollar is by far the most favored currency by Forex traders around the world at the moment. It’s not only a matter of safety, but it is a matter of the US economy doing much better than other world economies at the moment. While Britain is a necessarily in a horrible spot, it’s not the US, and that’s what matters.

Ultimately, I am a seller time and time again until we get above the 1.60 level, which is something that I don’t see happening anytime soon as the downtrend has been so strong for so long.