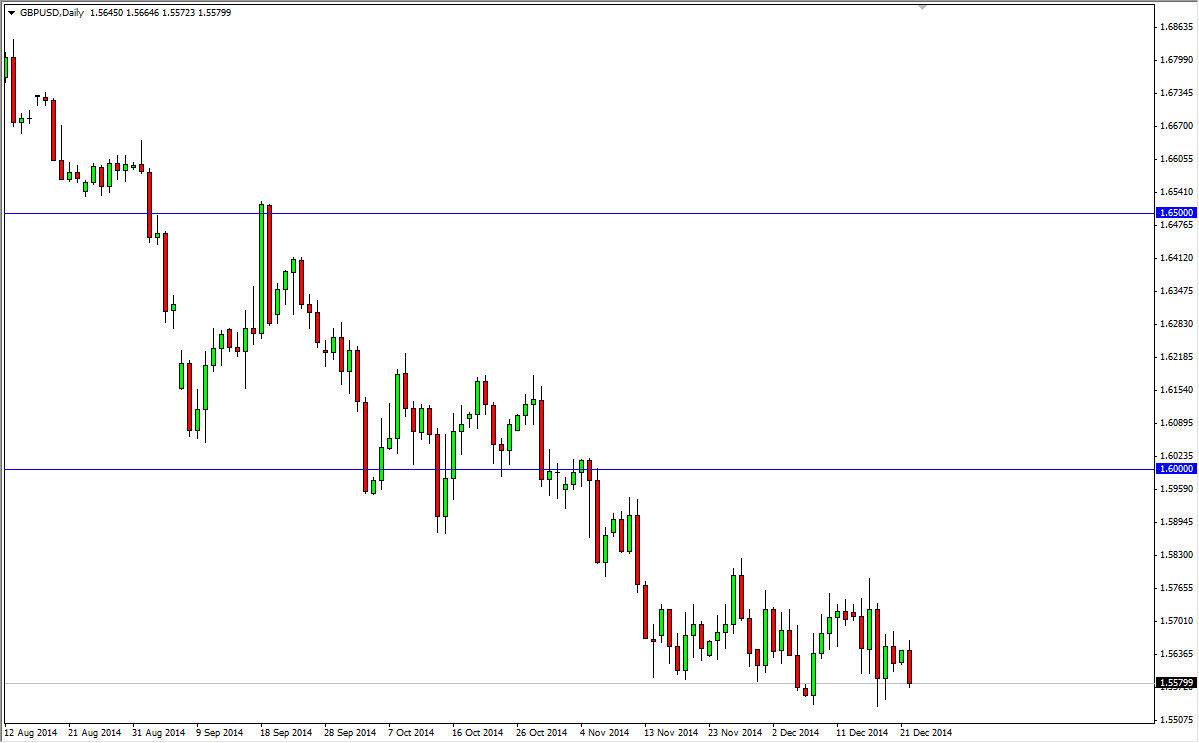

The GBP/USD pair fell again during the session on Monday, as we had initially tried to rally. However, you can see that the area above the 1.5650 level of course offered quite a bit of bearish pressure, sending this market down towards the 1.5575 handle. Given enough time though, I believe that this market will finally break down but it needs get below the 1.55 handle in order to feel comfortable shorting this market for any real length of time. With that, I am being patient as far selling is concerned, or my even wait for a short-term rally in order to do so.

If we get below the 1.55 handle, the market should then head to the 1.50 level. That of course is a large, round, psychologically significant number. With that, it’s probably only a matter of time before the sellers really pick up the pace to the downside, and you have to keep in mind that even though the British pound itself isn’t too soft, it’s the US dollar that you are buying. That’s the real trade, buying the greenback.

Longer-term downtrend

I believe that the longer-term downtrend should continue, but I don’t know whether or not we can get below the 1.50 level. Quite frankly, that’s a pretty major area, so that might be the end of the massive selloff that we have seen for some time. With that, I am still bearish, but I recognize that the trend has run its course for some time.

I would love to see a rally quite frankly, as it would represent value in the US dollar, and also could be used to pick up momentum to the downside. I don’t level get it, so because of that I am also willing to sell a break below the 1.55 level that closes on the daily chart down there. I don’t know that we will have a good trade today, but this is a pair that we need to pay attention to as we are approaching fairly crucial levels.