GBP/USD Signals Update

Yesterday’s signal was not triggered as the price did not reach either of the key levels during the London session.

Today’s GBP/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.5608.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remove of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 1.5500.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 25% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

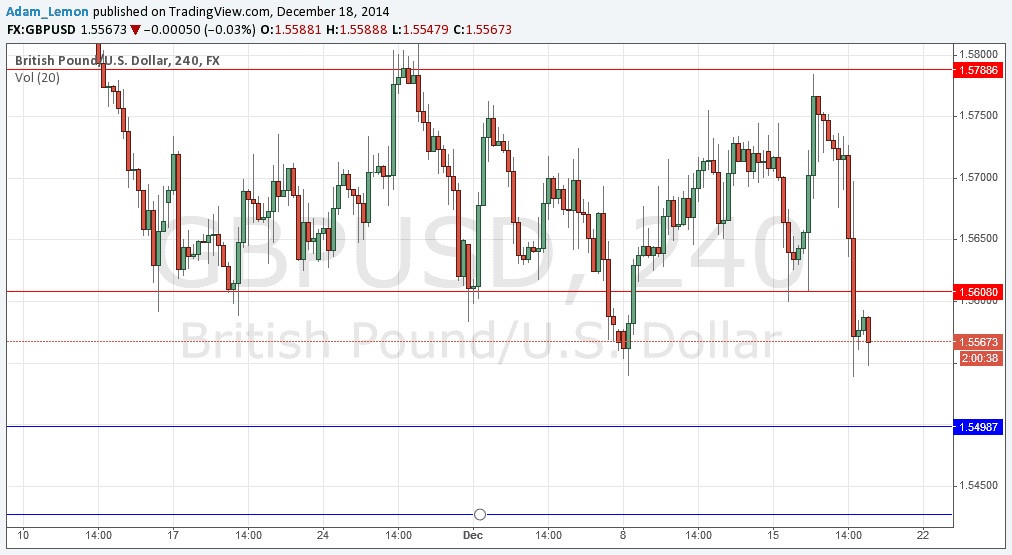

GBP/USD Analysis

Yesterday saw FOMC developments kick start a resumption of the bullish USD trend which has caused this pair to fall below the previous crucial support at around 1.5600. This previously supportive area, confluent with a round number, is now likely to be resistant.

There is local support below at 1.5550 and more serious support below that cnfluent with a previous key swing low at the psychological number of 1.5500.

There are high-impact data releases scheduled today directly concerning both the USD and the GBP. At 9:30am London time there will be a release of U.K Retail Sales data. Later at 1:30pm there will be a release of U.S. Unemployment Claims data followed later at 3pm by the Philly Fed Manufacturing Index.