GBP/USD Signals Update

Yesterday's signals were not reiggered and expired.

Today’s GBP/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.5789.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately following the next touch of 1.5591.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

I wrote yesterday that it was likely to be a fairly choppy and indecisive day for this pair and that prediction was fairly correct.

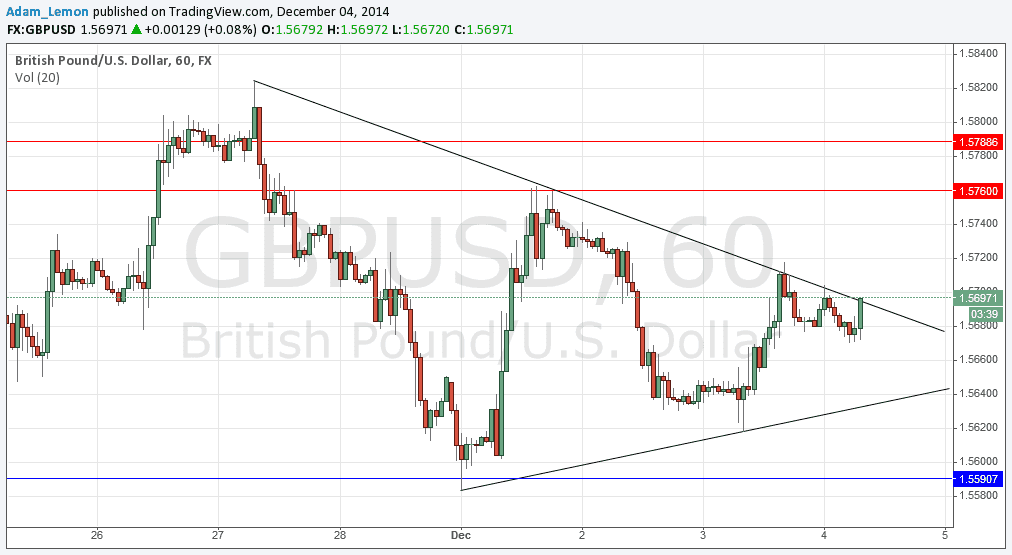

This pair looks interesting now as it is trying at the time of writing to break up through the upper trend line of a consolidating triangle. It is currently failing to do so, but if it does, this pair can move fairly quickly and explosively, so it might be a good opportunity for a long breakout trade. Alternatively, failure off the trend lines can be faded. It is quite likely there will be no breakouts until after the major news releases that are due later today.

It looks like 1.5760 could also be a resistant area.

Despite these developments, I am sticking with the two key levels mentioned in the trade details above.

There are high-impact data releases scheduled today directly concerning both the GBP and the USD. Regarding the GBP, there will be a release of the Official Bank Rate and statement at Noon London time. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm. It is likely to be volatile from about 11:30am.