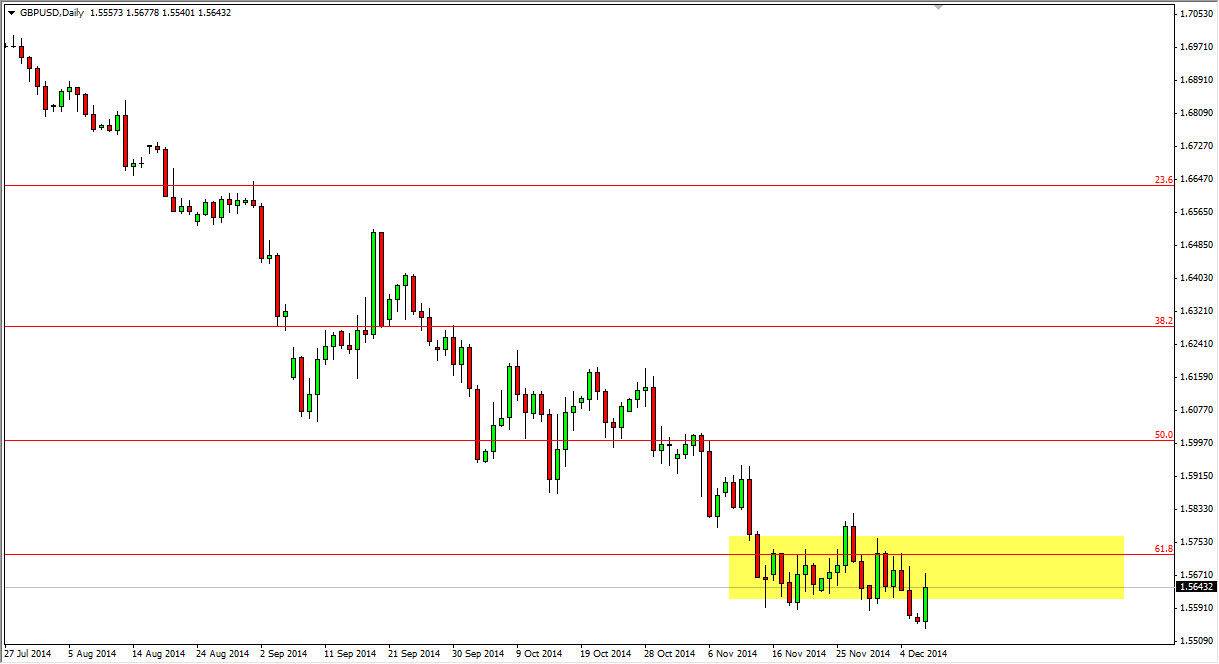

The GBP/USD pair broke higher during the course of the day on Monday, but as you can see we are still within the previous consolidation area, and the 61.8% Fibonacci retracement from the longer-term move, it’s of course could be resistance as well. On the other hand, the fact that we could not hang onto a significant portion of the gains towards the end of the session suggests that we may see selling pressure going forward.

I think that the area just above should offer selling opportunities on the short-term charts. I don’t know if we will get a daily candle that is were selling, but of course I would pay attention to that as well. Ultimately, I think this market needs to go back down to the 1.55 handle in order to tested for support, and quite frankly it would not surprise me at all if we well we down to the 1.50 level given enough time.

US dollar is king still

The US dollar of course is still king in the Forex markets, as we continue to see money flow into the United States. That being the case, we have to pay attention to the fact that the Federal Reserve has left the quantitative easing game while the rest of the world still continues. On top of that, you have to keep in mind that the European Union will more than likely slowdown going forward, and that will certainly put a bit of pressure on the British economy in general. After all, the British economy is highly intertwined with the European Union, so it makes sense that perhaps there might be a bit of trouble. Ultimately, I believe that the British pound will continue to fall against the US dollar in general. It’s not necessarily that I do like the British pound, it’s just that the US dollar is so strong at this moment in time. Once we get to the 1.50 level, I would rethink the entire thing, but at this point in time I just don’t see any way to be going long of this market.