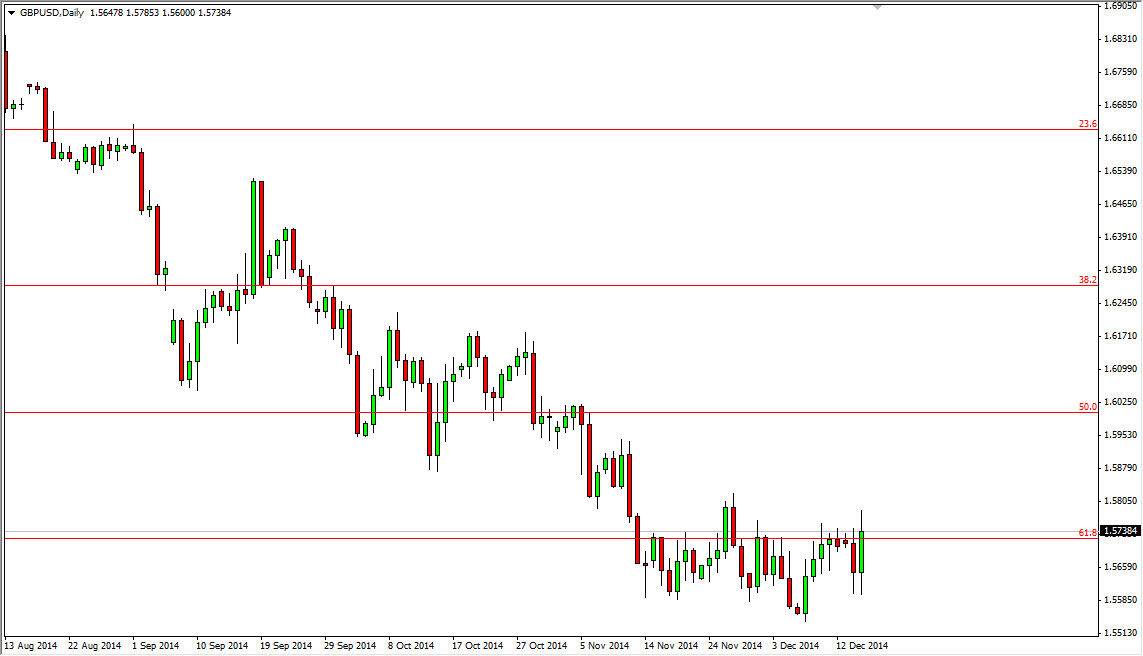

The GBP/USD pair initially fell during the course of the day on Tuesday, but found enough support near the 1.56 level to turn things back around and head towards the top of the consolidation area. With that being said, there is a significant amount of resistance just above and I believe that the 1.58 level will keep the buyers at bay. However, it’s very likely that the economic announcements coming out of the United Kingdom could move the markets today, so keep in mind that volatility could reenter the picture.

I think that the trend could change if we break above the 1.60 handle, but ultimately I think it’s very hard to get above that level. In the meantime though, I think that the volatility in the markets will increase due to the fact that we will have low liquidity, so at this point in time almost anything is possible over the next couple of weeks.

Rallies represent selling opportunities until we break the 1.60 handle.

I believe that rallies will represent value in the US dollar, meaning that the pair will more than likely run into significant selling pressure over time he goes higher, ultimately testing the bottom of this consolidation area. With that being the case, I am still bearish overall and I do believe that we will eventually test the 1.55 handle, although it might be difficult to see that happening over the next couple of sessions. We may need to switch to the short-term charts in order to make any real money in this market, as it should continue to be one that’s very volatile as Forex markets will wind up trying to take profit for the year.

I would be surprised if we got below the 1.55 handle, but even this late date in the year would not keep me from selling as I believe that would open up the floodgates and send this market down to the 1.50 handle. If we broke above the 1.60 level, I have to reassess everything but I still believe that’s very unlikely.