By: John Ursus

Timeframe: W1

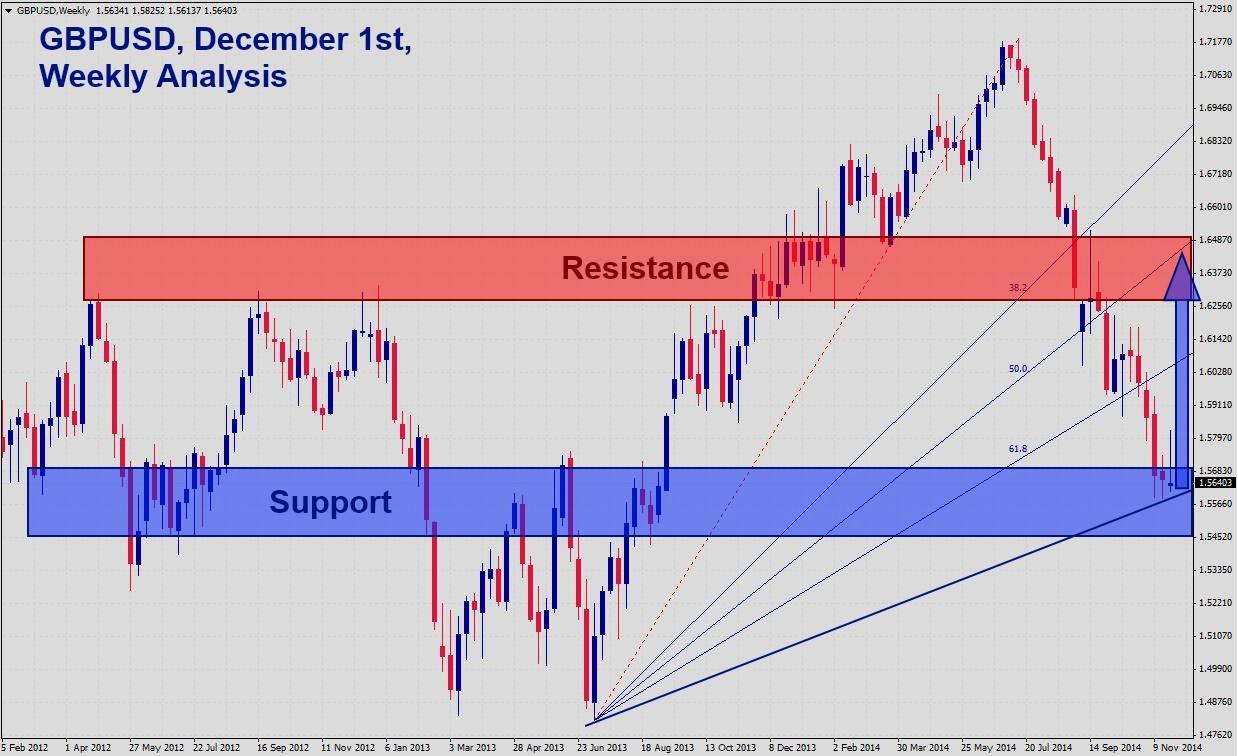

Recommendation: Long Position

Entry Zone: 1.5550 – 1.5650

Take Profit Zone: 1.6300 – 1.6400

Stop Loss Zone: 1.5300 – 1.5400

The GBPUSD has been caught in a prolonged correction over the past four-and-a-half trading months as an increase in interest rates seems to be off the table for the next few months while the UK economy is heavily supported by government spending offsetting a contraction in exports and business spending. The correction took this currency pair from an intra-day high of 1.7191 to an intra-day low of 1.5589 from where the GBPUSD stabilized. This currency pair is expected to be faced with a short-covering rally from extreme oversold conditions.

The four-and-a-half month correction took the GBPUSD below its Fibonacci Retracement Fan and there is no resistance level standing in the way of a move higher until it reaches its 61.8 Retracement Level. The expected short-covering rally could gain enough upward momentum to extend its rally beyond that point. Forex traders are advised to spread their entries over a 100 pips range between 1.5550 and 1.5650. The downward potential appears to be rather limited while the upside potential remains very attractive.