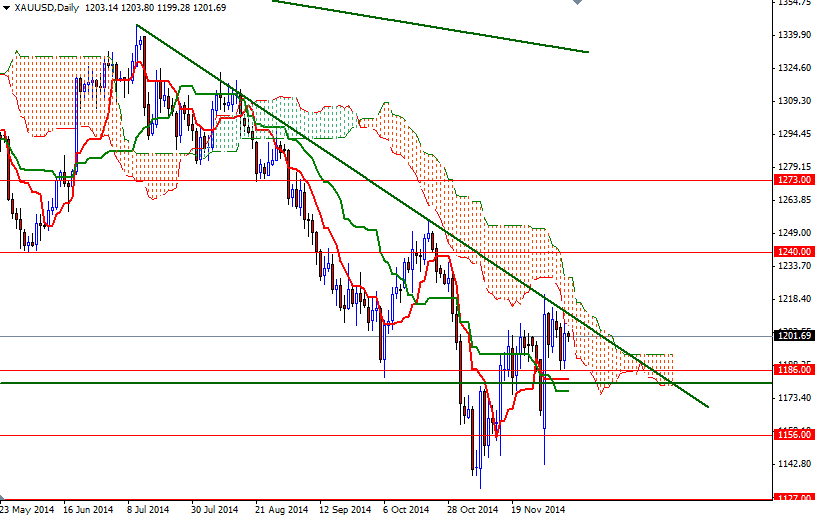

Gold market initially fell during the course of the day on Monday, but we have found enough support around the $1186 level to reverse the course and touched the bottom of the Ichimoku cloud on the daily chart. Gains were supported by a drop in equities and weakness in the dollar. Although the market have been under a heavy selling pressure since prices touched $1344.92 in July, we have seen some significant buying recently. The XAU/USD pair has rebounded 6.2% from a 4-1/2 year low of $1131.96 hit last month.

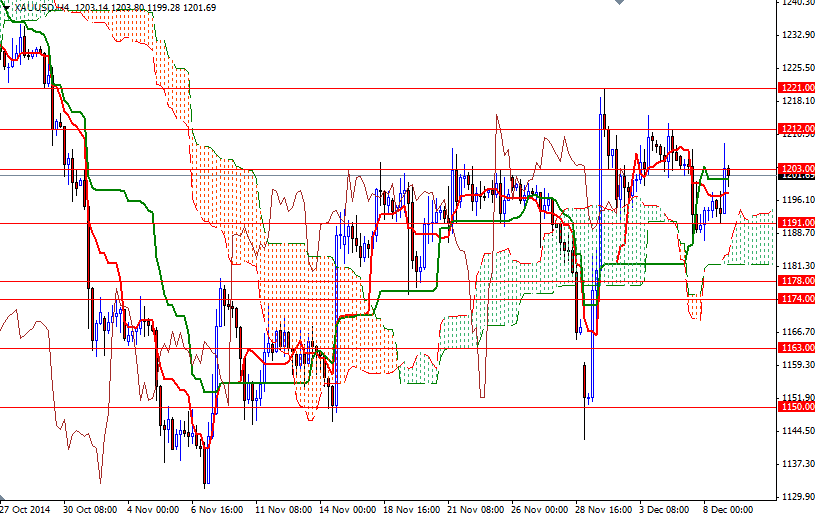

At this point, the short-term and long-term charts point opposite directions. On the 4-hour time frame, the XAU/USD pair is moving above the clouds whereas on the daily time frame the pair is trading beneath the clouds. Because of that, I prefer to wait rather than to jump right into the fight.

I think the bulls will need to pass through the 1212- 1221 zone -where the descending trend-line originating in July and the daily clouds converge- if they intend to march towards the 1235/40 resistance. To the downside, I will be keeping an eye on the 1191/86 region. If the market drops below that level, then we will probably test the support at 1181.88. A daily close below the 1174 support level would confirm that the momentum is once again turning bearish. In that case, I think the bears will be targeting the 1163 level.