Gold ended the day up 3.7% at $1,211.95 per ounce, bouncing back from a slide earlier that came after Swiss voters rejected a measure that would have required the SNB to increase its gold reserves, as Moody's downgrade of Japan spurred safe-haven demand. Moody's Investors Service cut Japan's government debt rating by one notch to A1 over rising doubts about its ability to reduce debt levels. The precious metal got extra lift from declines in the U.S equity markets and dovish comments from top Federal Reserve officials. New York Fed President William C. Dudley said "It is still premature to begin to raise interest rates. When interest rates are at the zero lower bound, the risks of tightening a bit too early are likely to be considerably greater than the risks of tightening a bit too late".

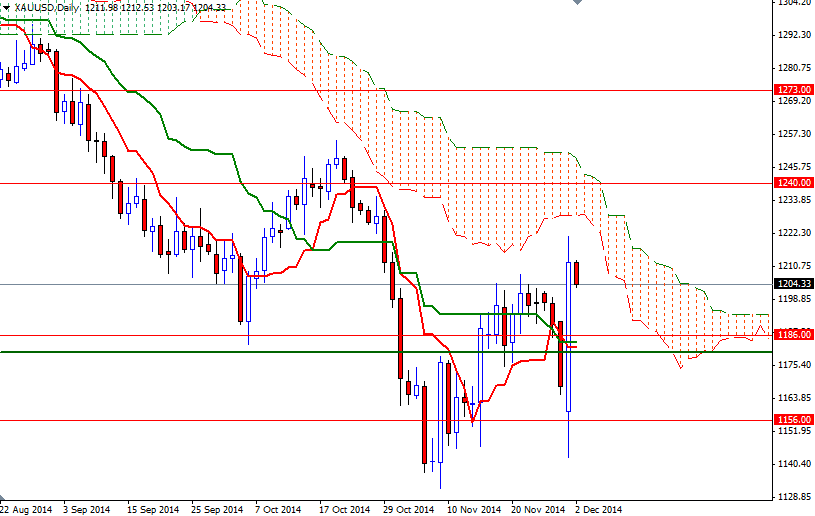

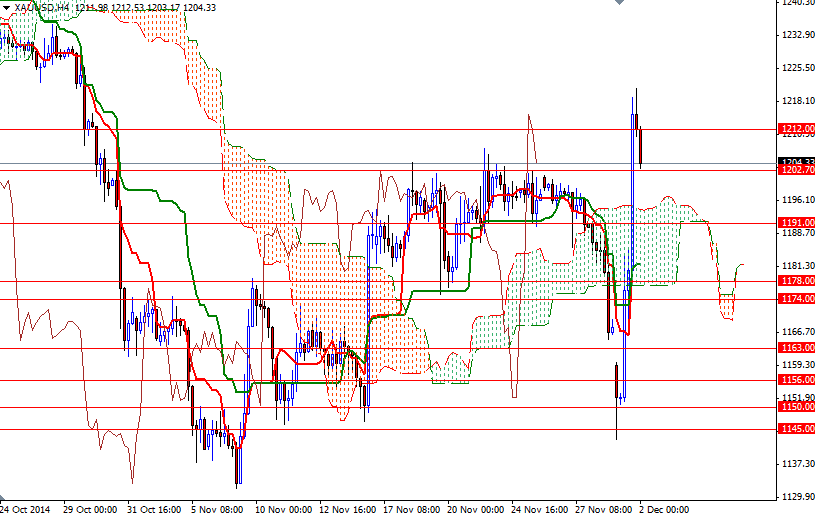

From a technical point of view, yesterday's candle which engulfed the trading range of the previous 10 trading days was a significant indication that the lower prices are being rejected. The XAU/USD pair broke through the Ichimoku cloud on the 4-hour time frame and in addition to that the Chikou-span (closing price plotted 26 periods behind, brown line) climbed above prices. Although the broader long-term trend remains negative, short-term charts suggest that the bears became exhausted.

The market is currently trying to hold above the 1202.70 level which had blocked the bulls' way during the past couple of weeks. The bears will have to pull prices below this level so that they can force the market to retest the 1196/1 area. Only A break below the 1191 support level could provide the bears extra power they need to visit 1182. However, If the XAU/USD pair resumes its bullish sentiment and penetrate the barrier at 1212, the bulls may find a chance to test the 1222 level. Once beyond that, the market will be aiming for 1228 and 1235/40.