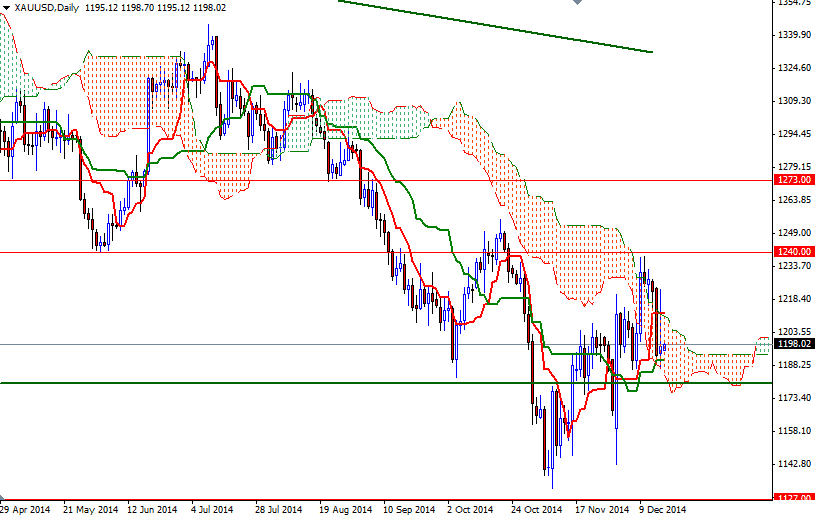

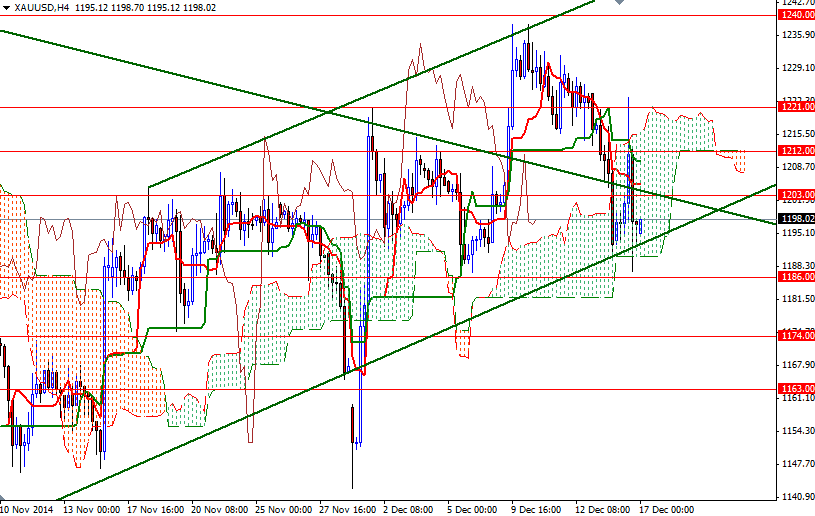

Gold prices closed slightly higher on Tuesday after falling 2.5% the session before. The XAU/USD pair initially tried to rally, at one point even managed to climbed above the $1212 level and tested the resistance at $1221. However, as can be seen on the daily chart, sellers stepped in and prices retreated all the way back to the bottom of the Ichimoku cloud.

The prospect of a hawkish policy statement from the Federal Reserve is putting a significant amount of pressure on the market and as a result some investors are just waiting on the sidelines until they get a clearer picture from the central bank. Although the Fed acknowledges raising interest rates prematurely is a greater risk than lifting them too late, a number of policy makers want to move away from promising to keep rates low for some unspecified period of time.

The XAU/USD pair is currently trading around the 1198 level as markets are waiting for the FOMC statement and Chair Janet Yellen's press conference at the end of its two-day policy meeting today. The market is moving within the borders of the Ichimoku clouds on both the daily and 4-hour charts and that indicates the market is looking for a direction. In the meantime, I will be keeping an eye on the 1186 and 1203 levels. If the XAU/USD pair drops below the 1190 - 1186 zone, the market will probably test the supports at 1178 and 1174 afterwards. Breaking below 1174 would suggest that the bears will be targeting the 1163 level next. If the bulls gain some strength and push the XAU/USD pair above the 1203/5 resistance, then it will be possible to see the bulls challenging 1212 (or perhaps 1221) again. Only a daily close above the 1221 level would make me think that the bulls are strong enough to tackle the 1233 and 1240 resistance levels.