Gold prices retreated on Monday, erasing most of the previous week's gains, as better than anticipated data out of the world's largest economy stoked speculations of a hawkish stance from the U.S. Federal Reserve. Figures from the Federal Reserve showed that industrial production climbed 1.3% after a 0.1% increase in October. Signs of sustained improvement in the U.S. economy make people think that the central bank will change its language on interest rates.

Dropping “considerable time” is likely to be a challenge because the last thing the Fed wants is to cause instability. The Fed still views the timing of a first rate hike as entirely dependent on the economy’s progress. However, the central bank will eventually change its forward guidance on interest rates and that is putting extra pressure on the precious metal. Apparently, some investors don't want to take big risks prior to the Federal Open Market Committee meeting.

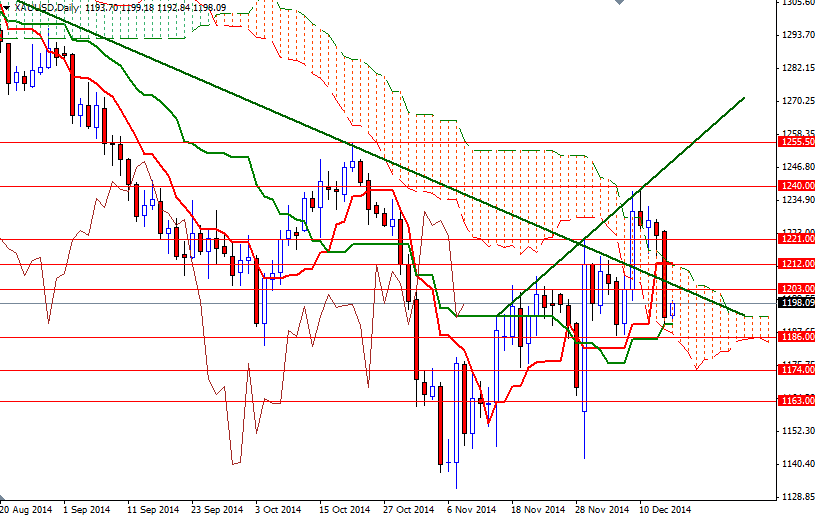

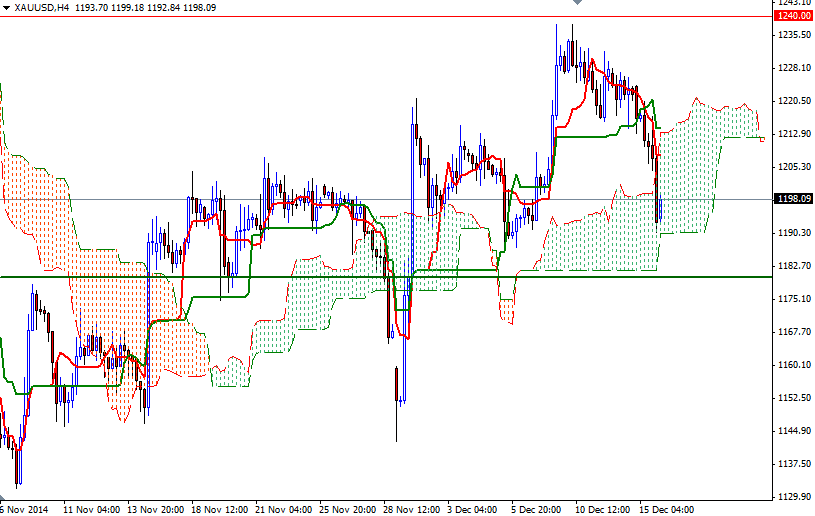

Breaking below the support at $1212 was another important factor of course. In my previous analysis, I had mentioned that this level was the key to lower prices in the short term. Not surprisingly, the XAU/USD pair dropped all the way back to 1193/1186 area right after the 1212 level gave way. Prices edged higher during today's Asian session after touching the Kijun-Sen (twenty six-day moving average, green line) on the daily chart but the bulls will have to pull the market above the 1212 level if they don't intend giving up the fight. Climbing above this strategic level would suggest that the bulls are planning a fresh assault on the 1221 resistance level. On the other hand, if prices resume the bearish tone of the last few days and fall through 1186, it is likely that we will see the XAU/USD pair testing the support levels at 1178 and 1174. Once below that, the next stop will probably be the 1163 level.