Gold prices ended Wednesday's session up 0.98%, or $12.10, to settle at $1209.42 an ounce as the bulls gained some strength after the ADP private jobs data fell short of market forecasts. Figures from the ADP Research Institute revealed that private sector added 208000 jobs in November, less than expectation of 222000. Even though the data shows hiring dropped to a three-month low, I think the labor market the labor market is still in good shape. However, as I often say, its not the news but the market's reaction to news that matters.

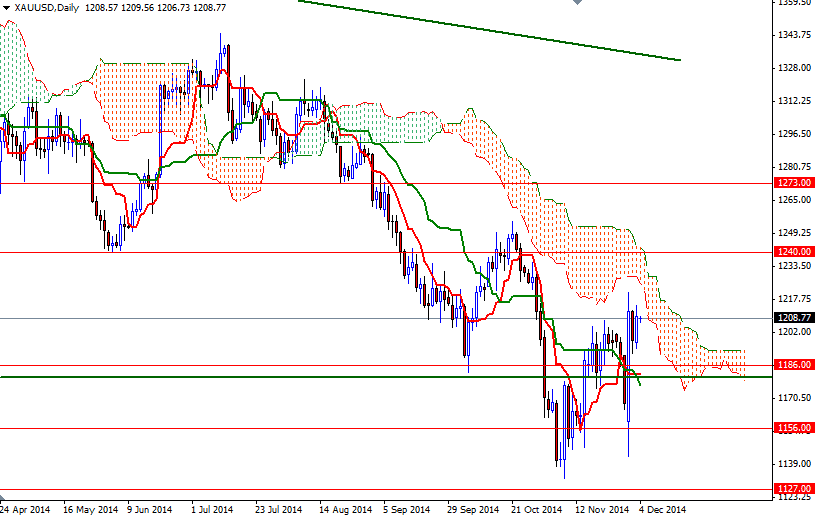

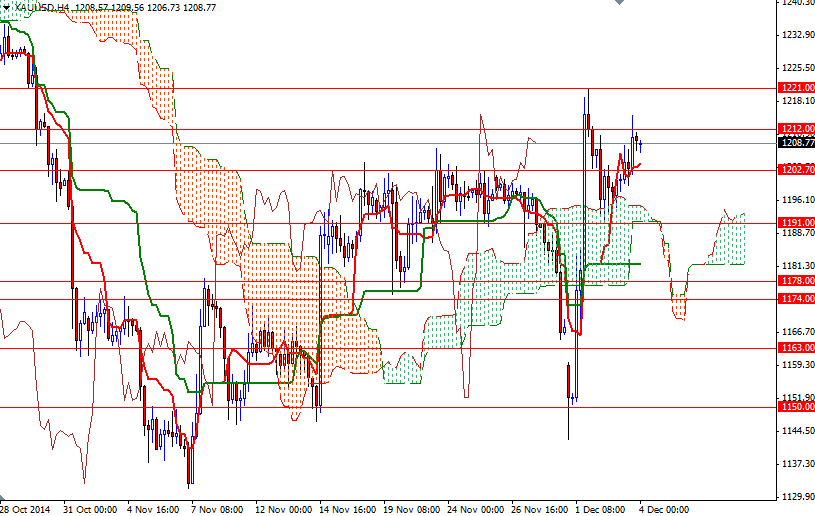

Yesterday, the XAU/USD pair made a fresh assault on the 1212 resistance level after penetrating 1202.70 but the bears increased pressure and blocked the way. As I mentioned in my previous analysis, Monday's rally created a positive sentiment in the market but until the bulls capture the first strategic camp at the 1240 level, there will be serious doubts whether we have a short term bullish trend or this is just another retracement.

On the daily time frame, the Ichimoku clouds are on top of us. These clouds not only identify the trend but also define support and resistance zones. The thickness of the cloud is relevant too, as it is more difficult for prices to break through a thick cloud than a thin cloud. With that in mind, I think the bulls will have to push the market beyond the 1212 level first. If the XAU/USD pair climbs above yesterday's high, we might see a bullish continuation targeting the next barrier at 1221/5.37. To the downside, support can be found at 1202.70 and 1193/1. Breaking below the 1191 support could take us back to the 1186/2 area.