The XAU/USD pair (Gold vs. the American dollar) ended Tuesday higher than opening after the bulls managed to push prices above the $1193.55 resistance level. Much of the volatility was driven by heightened risk aversion and weaker American dollar. Worries about Greece's future in the eurozone triggered safe-haven bids for the precious metal and the greenback took a breather after a recent rally to a near nine-year peak.

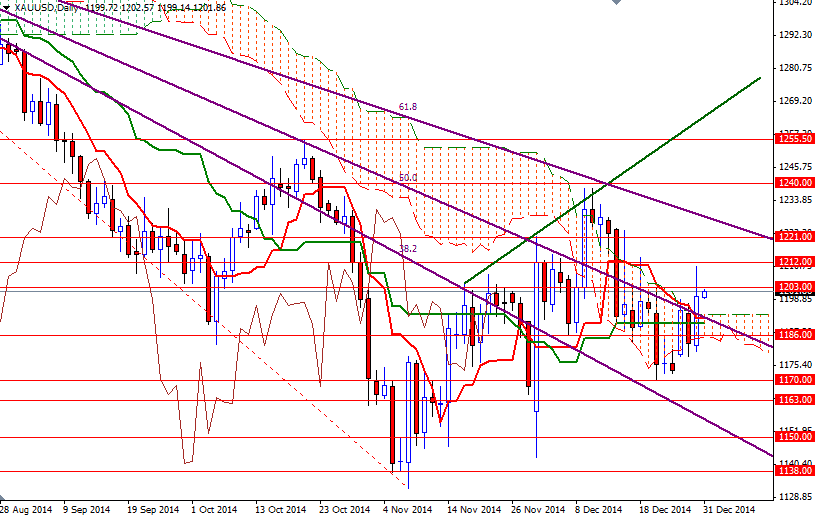

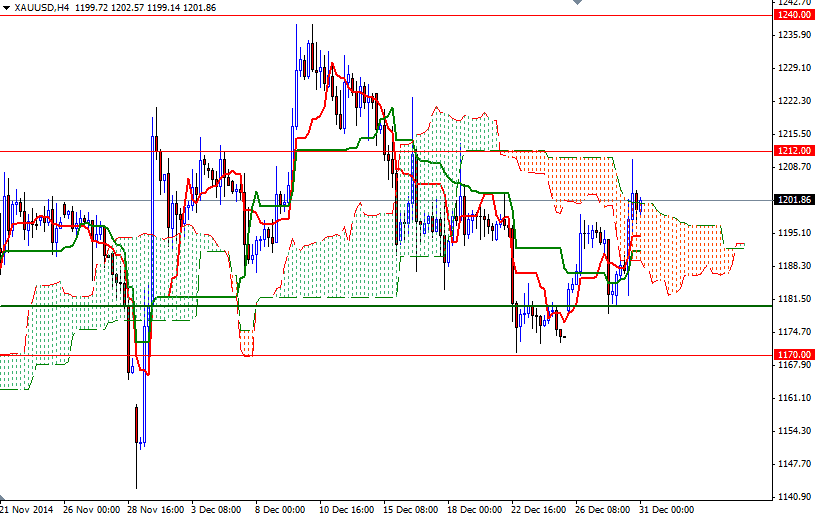

Yesterday's price action pulled the XAU/USD pair above the Ichimoku cloud on the daily time frame and I think that is something to pay close attention. Bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses on both the daily and 4-hour charts suggest that lower prices are rejected by investors at the moment. From an intra-day perspective, resistance to the upside will be found at 1203 and 1212 If the bulls clear the resistance at 1212, it is likely that the market will test 1221 next.

However, if the bulls fail to penetrate the 1203 - 1212 zone and prices start to retreat, expect to see some support between the 1193.55 and 1185.38 levels which define the borders of the Ichimoku cloud on the daily chart. Closing back below the clouds would indicate that the market is getting ready to revisit the support at 1178/6.