Gold prices advanced 2.2% on Tuesday, extending their gains to a second straight session, as concerns over volatility in the global equities and strength in the Japanese yen increased demand for the precious metal's appeal. Market players moved away from stocks and sought safe havens after the government in Greece announced it would hold the presidential election two months ahead of schedule. Gold traded as high as $1238.10, the highest since October 24, before easing back to the $1228.

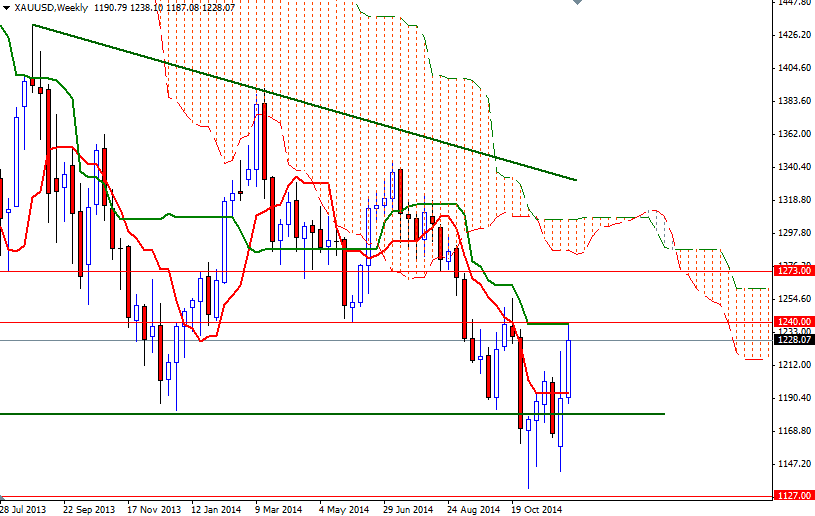

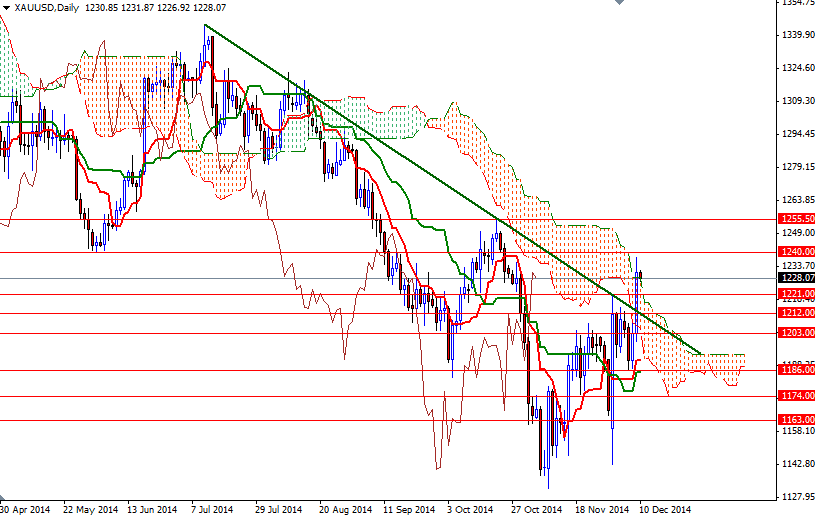

As I repeated lately, the resistance between the 1212 - 1221 levels was the only hurdle blocking the bulls' advance towards the 1235 - 1240 area. Not surprisingly, gold accelerated its ascent after penetrating this critical barrier and reached the Kijun-Sen (twenty six-day moving average, green line) on the daily chart. Now the question is whether or not prices will continue to rise. Yesterday's surge in gold altered the short term outlook as the market broke the descending trend-line dating back to the July high of 1344.92. In addition, the market is now trading above the daily Ichimoku cloud and the Chikou-span (closing price plotted 26 periods behind, brown line) on the 4-hour chart indicates a solid momentum.

Gold usually tends to gain during times of uncertainty and it seems that retreats in stock markets will be supportive in the near term. I think the bulls will have to hold prices above the 1212 level if they are determined to dominate the market. 1235/40 will be the key resistance for the bulls to pass in order to challenge the bears at the 1250 -1255 battle field. However, if the bulls run out of steam, it is likely that the XAU/USD pair will revisit 1224 and 1221. Below that, expect to see some support at 1215/12.