Gold prices ended lower on Wednesday, pulling back after sizable gains in the previous two sessions, as investors covered some bullish bets. The day before yesterday, the slide in equity markets dented risk appetite and pushed gold prices to their highest in seven weeks. Honestly, it is not surprising to witness some volatility in gold prices as the market sees profit taking this time of year.

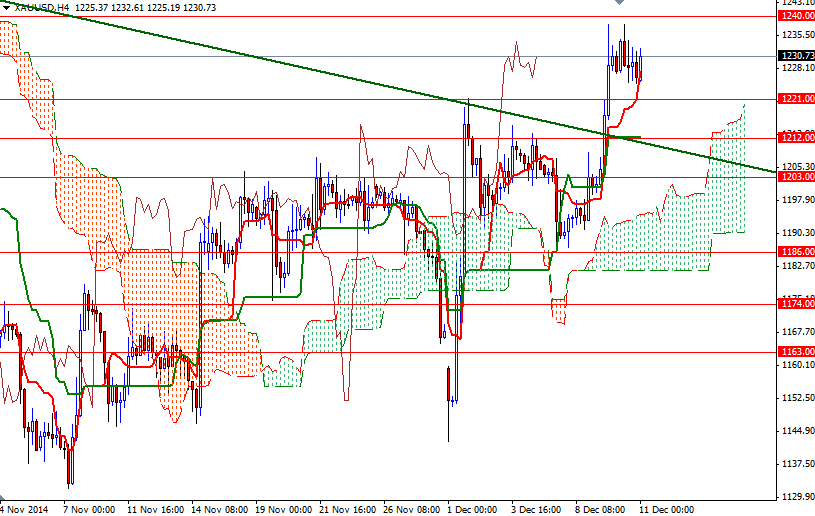

Today gold is trading at $1230.73 per ounce and the price action indicates that the war between the bulls and bears intensified in the 1240 - 1221 zone. Although the precious metal finds support from weaker equities, people may be hesitant to put more money into gold before they see the Federal Reserve's next move. The policy-setting Federal Open Market Committee’s next meeting is scheduled for December 16-17.

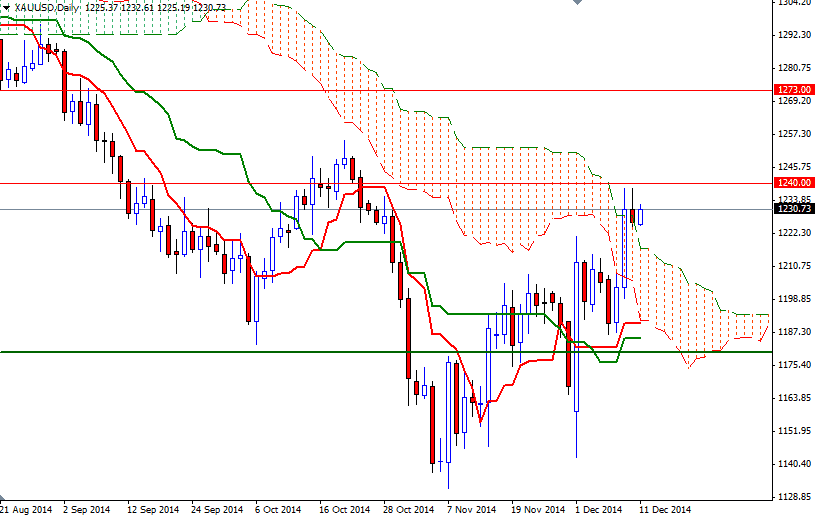

Technical outlook suggests that the bulls are in control at the moment. The XAU/USD pair is trading above the Ichimoku clouds on the daily and 4-hour charts. We also have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses on both time frames. On the other hand, I think the 1235/40 resistance is going to be crucial going forward. Breaking through this former support/resistance is essential for a bullish continuation. In that case, the next stop will probably be the 1250/55.50 area. In order to put some pressure on the market, the bears have to push prices back below the 1221 level. If the XAU/USD pair falls through this support level, I think they will find a chance to test 1217 and 1212.