Gold prices ended Thursday's session up 0.2%, or $2.42, to settle at $1227.79 an ounce. The precious metal came under pressure after the Commerce Department reported that retail sales rose 0.7% in November and the Labor Department said the number of Americans filing applications for jobless benefits decreased by 3K to 294K. The XAU/USD pair traded as low as $1215.83 but prices reacted with bullish sentiment after hitting that low and moved back up.

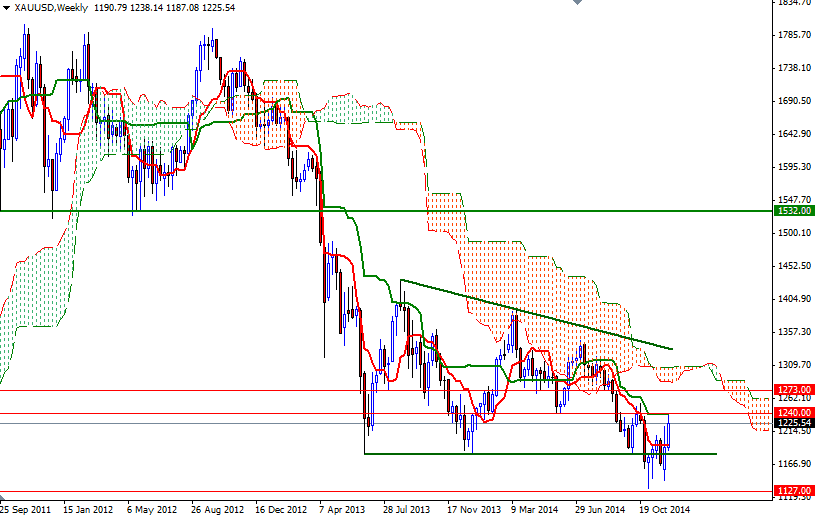

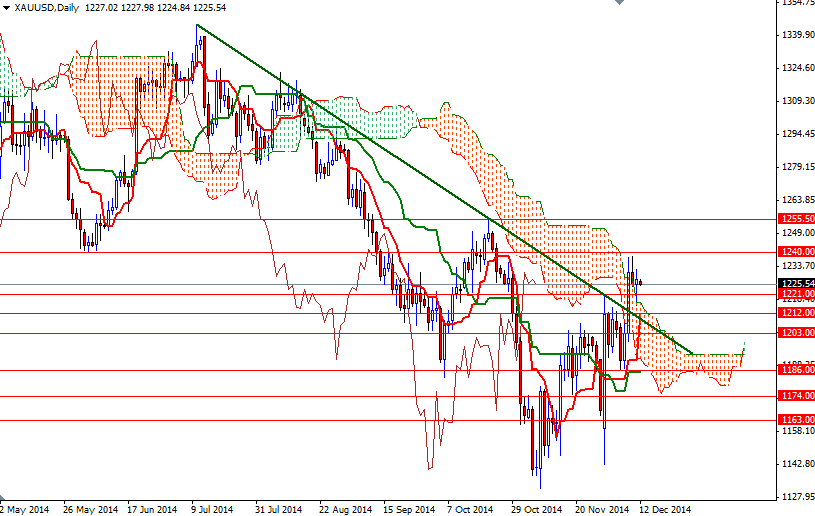

Increasing demand for protection against volatility in the global stock markets have been driving this recent bullish activity but persistent strength in the dollar and declines in energy prices -which reduce the inflation expectations- continue to create headwinds for the market. Because of that, the market may remain range-bound (between the 1212 and 1240 levels) in the short-term.

Technical outlook is positive while the XAU/USD pair is moving above the Ichimoku clouds on both the daily and 4-hour time frames. However, the bulls have to pull prices above the 1233 level so that they can gain enough momentum to approach the 1240 resistance. Shattering this barrier might lure new buyers to the market and extend gains towards the 1250/55 zone. If the bulls run out of gas, there is a possibility of prices heading lower towards the 1221/17.80 support. Falling through this area could take us back to the 1212 level where the Kijun-sen line (twenty six-day moving average, green line) currently resides on the 4-hour chart.