By: Stephanie Brown

HSBC recently severed its ties with GA Advisors, the world’s first regulated Bitcoin investment fund. Supposedly, the bank was worried about a “money laundering risk” activities in the Bitcoin industry.

Global Advisors’ Daniel Masters believes that the step taken by HSBC will prove to be a huge hurdle for the Bitcoin investment fund, which he claims had received all the important regulatory approvals. This implies that the Bitcoin investment account was open for pension funds and other highly desirable investments. However, such an opportunity has gone by the wayside according to Masters.

The founder of TransferWire, a renowned Bitcoin company, firmly believes that Bitcoin could truly transform the way individuals transfer money and how they conduct online transactions. He believes that banks charge exorbitant fees for simple tasks such as transfer and deposits, which in his opinion could become a thing of the past once users are introduced to the world of Bitcoin.

According to him, Bitcoin will give users the ability to enjoy all banking services at minimum costs and more importantly without any hassle. However, he insists that fellow developers must work on generating better security features, which will hopefully attract a larger number of users.

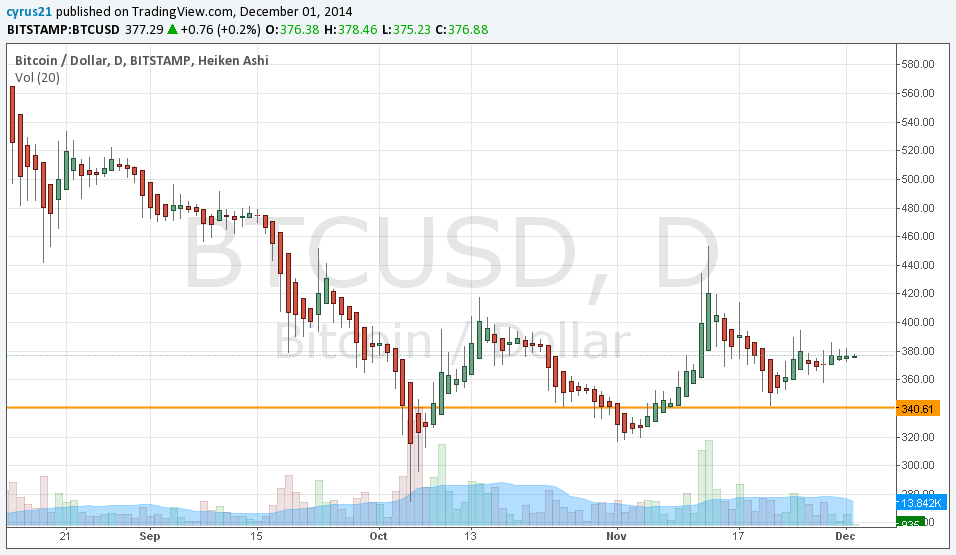

Technical Analysis

The BTC/USD continues to trade in a no-trading zone, as it is flattening day after day. Both the bulls and bears are eagerly waiting for a break-out on either side to speedily come to fruition. Going forward the BTC/USD has support at $366, $360, while its resistance continues to linger at $382, $388.

Actionable Insight

Sell the BTC/USD below $374 for target of $370, $366 with a stop-loss of $376.