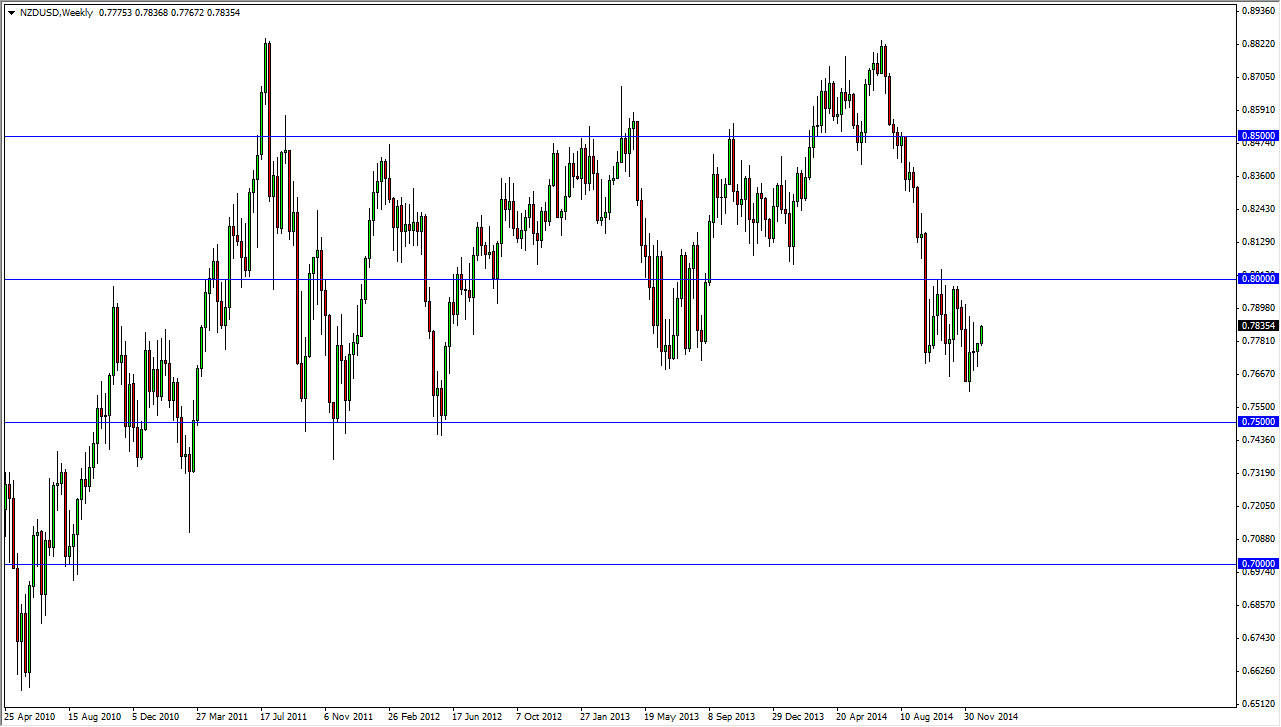

The NZD/USD pair has been consolidating for some time now, just below the 0.80 handle. I believe that this pair will continue to do so during the month of January, and that every time we head towards the 0.80 level, we should see sellers step back into the marketplace. After all, the New Zealand dollar is very highly sensitive to the commodity markets, and although I think that the US dollar is a bit overbought at this point in time, I have a hard time believing that people will suddenly flood into New Zealand as a result.

I think that this market will try to find the 0.75 level during the month, although we may not make it. The Royal Bank of New Zealand continues to try to jawbone the value of the Kiwi dollar down, and with that I feel it’s only a matter of time before the bank gets what it wants.

Selling rallies

The only way that I am going to trade this pair is simply selling the rallies as they appear. Quite frankly, if we break above the 0.80 level, that would be a bit confusing for me and I might actually just step aside for a while. On the other hand, if we have resistive candles that for me is a nice signal to continue to push to the downside. I have no interest in buying the New Zealand dollar and the near term, and I believe that at least the 0.75 level needs to be tested.

Ultimately, I believe that the commodity markets are going to stay a bit on the soft side, at least for the month of January. With that I believe that there is far too much in the way of bearish pressure on the Kiwi dollar as it’s hard to imagine that there are other reasons to be involved at this point. True, the interest-rate differential favors New Zealand, but at the same time the US economy is by far the best performing major one that we follow.