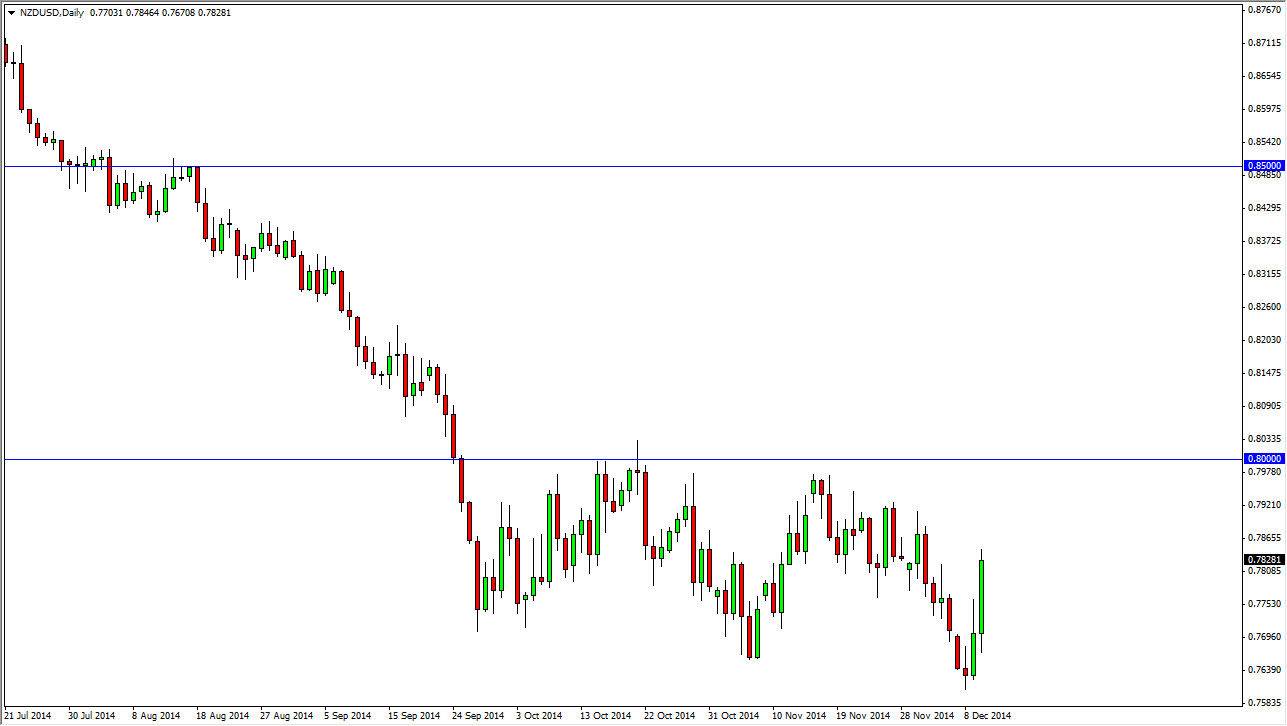

The NZD/USD pair initially fell during the course of the session on Wednesday, but turned back around to break above the 0.78 level. After all, we are still in the middle of consolidation, and as a result more than likely we should see selling pressure sooner or later. Remember, the Royal Bank of New Zealand is looking to bring down the value of the Kiwi dollar, and as a result it’s almost impossible to imagine buying this market. In fact, I believe that the 0.80 level above should be massively resistive, and I think that’s the essential “ceiling” in this market.

The candle is strong looking, so I think that we could get a little bit of follow-through, but ultimately it’s only a matter time before the sellers take over again. All I’m doing is waiting for some type of resistant candle in order to take advantage of relatively soft commodity markets, which of course could bring down the value of the New Zealand dollar in general.

Longer-term downtrend

The pair is most certainly in a longer-term downtrend anyways, so ultimately you it’s only a matter of time before the overall trend takes over again. Remember, the US dollar is the strongest currency in the world right now, and as a result it’s difficult to go against it, especially with a high risk currencies such as the New Zealand dollar. I would be rather surprised we got above the 0.80 handle, because that would be a major break out in my opinion.

Ultimately though, I believe that the market should head to the 0.70 handle, because the Royal Bank of New Zealand is looking for an exchange rate closer to the 0.68 handle. I don’t know will go all the way down there, but we certainly will make an attempt to get closer to it. With that being said, I have the impression that the first part of the year will continue to see selling but we could possibly see a little bit of profit taking in the short-term, and that might be what’s going on right now.